At noon yesterday, after the exam, people who took the national civil service exam walked out of the examination room of Beijing Union University. Our reporter Zhang Tao photo

(Reporter Jiang Yanxin) At 9: 00 am yesterday, the national civil service examination was officially opened in 2009. The number of people taking the national civil service examination this year is about 775,000, more than 130,000 last year, and the number of candidates is the highest in the past years. Although the central authorities and their directly affiliated institutions plan to enroll 13,500 civil servants in 2009, which is slightly higher than that in 2008, the admission rate is still only 1.75%.

Candidates with low admission rate laugh at themselves as "cannon fodder"

Yesterday’s exam was arranged for administrative professional ability test (9: 00 am to 11: 00 am) and application (2: 00 pm to 4: 30 pm). Located in Muxidi, Xicheng District, the test center of Beijing No.8 Middle School Branch, the red banner indicates that the civil service exam will be held here. Although the entrance was prompted at 8: 40 on the blackboard at the school gate, from 8: 00 onwards, candidates came one after another and lined up naturally in order.

It is understood that in this year’s civil service examination, there are 95,000 candidates in Beijing, an increase of 15,000 over last year. Beijing has set up 132 test sites and 3,186 examination rooms in the city this year. This year, the proportion of the national civil service examination is 57: 1, which is more competitive than last year’s 46: 1. Many candidates who take the examination jokingly call themselves "cannon fodder".

Paying attention to the world food crisis by applying for the exam

In yesterday afternoon’s application examination, the theme of the examination questions was the food crisis. The reading materials provided by the examination paper amount to more than 9400 words. The question and answer includes seven aspects, which require candidates to summarize the causes of the world food crisis and the grain production situation in China from complicated materials. At the same time, candidates are also required to draft the Opinions on the Development of Grain Production as a functional department of the provincial government.

Zhong Jun, director of the Application Teaching and Research Section of Huatu Civil Servant Examination Research Center, said that this test closely follows social hotspots and focuses on the analysis ability of candidates and the ability to judge the effectiveness of some countermeasures in combination with the international and domestic situation.

Regarding why this topic was chosen, Zhong Jun said that food security is now a threat facing the whole world; At present, the financial crisis, oil shortage and other issues that everyone is generally concerned about are not particularly obvious around September when the exam questions are given.

The written test results will be announced in January next year.

It is understood that after the written examination of public subjects, the relevant departments will organize personnel to mark the papers, and it is expected that the written examination results will be announced in early January 2009. In order to avoid the problem of network congestion last year, this year’s candidates can also query by SMS. In addition, the interview and professional examination of the national civil service examination will be held before March 15, 2009, and the whole recruitment work will be completed before June next year.

-Related news

The exam is a serious violation of discipline for 5 years and cannot be re-tested.

(Reporter Jiang Yanxin) According to the relevant person of the National Civil Service Bureau, in order to purify the examination room environment and ensure fairness and justice, any candidate who is found by the relevant departments to be seriously violating discipline and discipline in the examination will be scored as zero, and will not be allowed to apply for civil servants again within five years. Many high-tech means have been used this year to investigate and deal with violations in the examination room. According to the relevant person in charge of the Beijing Municipal Personnel Bureau, radio signal shielding devices and radio signal monitoring vehicles have been set up in key test sites in Beijing. These devices can quickly find and accurately locate radio signals suspected of cheating, and at the same time investigate and block unknown signals and suspected cheating radio signals in time. In addition, the public security department will also strengthen the security patrol around the examination room to ensure the safety and fairness of the civil service recruitment examination.

-Key words of national examination

The examination questions are closely related to social hotspots and life.

Li Weiming, director of the quantitative relationship and data analysis teaching and research section of Huatu Civil Service Examination Research Center, said that the overall difficulty of this year’s administrative professional ability test is equivalent to last year, but the order of questions has changed. It is understood that this exam is closely related to social hotspots. The impact of the 2008 Beijing Olympic Games, the launch of the Shenzhou VII rocket, the subprime mortgage crisis and the significance of CPI are all reflected in this exam. At the same time, in the topic setting, many topics are more innovative, reflecting the timeliness and flexibility, and are closely related to life. For example, "Sima Qian and the rule of Wenjing, who was earlier"; For example, "what is the secondary meaning of the subprime mortgage crisis"; For example, "What school of thought of China was used in the’ harmony’ of the Olympic Games"; For example, "When did China’s 30-year economic system reform begin?" and so on.

Most candidates have not finished answering the questions.

There are 140 questions in the test, and some candidates report that some of the questions are too long and have too much reading. At 11 o’clock in the morning, the candidate Xiao Xia was a little depressed when he walked out of the test center of the Eighth Middle School: "The difficulty of the test questions is average, but the number of questions is too large. I only answered more than 90 questions. Other math problems can’t be solved by themselves, but they can only be blinded. It is estimated that they will be tested. " Xiao Xia said that he spent a lot of time reading books for this purpose, but unfortunately the effect was not good.

不少学生反映,两小时内要做完140道选择题,还要涂机读卡,实在没办法完成。据搜狐教育的调查显示,截至昨天中午12:00,超过5成网友认为试题难度中等,54.89%网友表示没有做完行政能力测验试题。

李委明主任表示,虽然今年依然有多数考生未答完全部题目,但和往年相比,答完的人相对较多。

专家 重考察考生分析能力

万学金路公务员研究中心专家表示,在行测考试中,今年的常识题从去年的完全考察法律常识,过渡到以国策考察为主的模式,让许多法律专业的考生显得有些“措手不及”。其中,只有6道法律常识题,而社会、经济、历史、时事题目则较大幅度增加。考试内容全面体现了考察考生知识面的广泛性,突出了对多种思维方式的考察和运用,特别是考生的分析能力成为考察重点。

同时,今年的题型保持稳定,但是给出的题干内容比往年有明显增加。总体阅读量继续增长。

本报记者 蒋彦鑫

责编:赵旋璇

Perspective on the amendment of insurance law: broadening the channels for the use of insurance funds

Xinhuanet Beijing, August 25th (Reporter Mao Xiaomei, Wu Jingjing) China’s current insurance law stipulates that the use of insurance funds is relatively narrow. However, in recent years, with the increasing scale of the insurance market, the rapid accumulation of insurance funds has become a bottleneck for the development of the insurance industry because of the narrow channels of application and the difficulty of maintaining and increasing value.

Wu Dingfu, chairman of the China Insurance Regulatory Commission, explained the revised draft of the Insurance Law at the fourth meeting of the 11th the National People’s Congress Standing Committee (NPCSC) on 25th, saying that the revised draft appropriately broadened the channels for the use of insurance funds, considering that the use of insurance funds should not only meet the needs of industry and economic development, but also take into account the principles of safety and stability. For example, the "buying and selling government bonds and financial bonds" stipulated in the current insurance law is revised to "buying and selling bonds, stocks, securities investment funds and other securities"; It is added that insurance funds can be invested in real estate.

In order to prevent risks in the use of insurance funds, the revised draft also authorizes the State Council insurance regulatory agencies to formulate management measures for the use of insurance funds in the form of authorization clauses, including stipulating the specific proportion of funds invested by insurance companies in a specific project to their total funds.

In fact, the investment of insurance funds in stocks and funds has already been broken through in practice. In recent years, according to the decision of the State Council and the actual needs of the development of the insurance industry, the China Insurance Regulatory Commission (CIRC) combined with the provisions of the current insurance law "other forms of capital utilization stipulated by the State Council", A series of regulations and normative documents, such as Interim Measures for the Administration of Insurance Companies Investing in Securities Investment Funds, Interim Measures for the Administration of Insurance Companies Investing in Corporate Bonds, Interim Provisions for the Administration of Insurance Asset Management Companies, Interim Measures for the Administration of Overseas Use of Insurance Foreign Exchange Funds, and Interim Measures for the Administration of Stock Investment of Insurance Institutional Investors, have been issued successively. While broadening the channels for the utilization of insurance funds and trying to innovate the organizational form of fund utilization, they have achieved a good balance between safety and efficiency and effectively prevented the risk of fund utilization. At present, insurance companies have become one of the most important institutional investors in the domestic capital market.

"The revised draft of the Insurance Law is the new investment channel approved by the State Council in recent years." Yang Huabai, director of the regulatory department of the China Insurance Regulatory Commission, told reporters.

As for the insurance law’s plan to "open the gate" for the first time to invest in real estate with insurance funds, the relevant person of the China Insurance Regulatory Commission said that the scale of real estate investment is large and the term is long, which is more in line with the characteristics of insurance funds pursuing long-term, valuable and steady investment. Opening this channel can give play to the capital financing function of insurance, support the national economic construction, optimize the insurance asset structure and cultivate a new profit model for the insurance industry. In practice, some insurance companies have tried to invest in developing commercial real estate.

Yang Huabai said that for the regulatory authorities, the implementation of any new investment policy must be based on effective prevention and control of risks. "Once the law allows investment in real estate, the CIRC will first limit the proportion of this investment in the company’s total funds in the future and formulate a specific method for real estate investment." Because the insurance industry’s investment in real estate is still unfamiliar and lacks professional experience, it is necessary to adhere to the system first and advance steadily.

According to the announcement, there are more than 100 Chinese and foreign insurance companies in China, and the total assets of the insurance industry are about 3 trillion yuan. In 2007, the balance of insurance funds in China reached 2.7 trillion yuan, which was 10.5 times that of 2000.

It is understood that in recent years, emerging insurance organizations such as cooperative insurance institutions and mutual insurance institutions have appeared in the insurance market. This revised draft adds provisions that insurance organizations in the form of mutual system and cooperative system shall be stipulated separately by laws and administrative regulations, and the provisions of this law shall apply to their insurance business activities. Thereby giving legal status to insurance organizations such as mutual system and cooperative system.

It is also known that the quality of insurance companies directly relates to the interests of the vast number of policyholders, insured and beneficiaries. In order to improve the quality of insurance companies, in this revision, the insurance law intends to make stricter provisions on the conditions for the establishment of insurance companies, and will clearly state the qualifications of company executives.

The revision of insurance law intends to improve the management of insurance intermediaries.

Xinhuanet Beijing, August 25th (Reporter Wu Jingjing, Mao Xiaomei) With the development of the insurance market, some new types of insurance intermediary service institutions have emerged in China, such as insurance assessment institutions, which need to be regulated by law. The revised draft of the Insurance Law, which was deliberated at the fourth session of the 11th the National People’s Congress Standing Committee (NPCSC) on 25th, further improved the management of insurance intermediaries.

When explaining the revised draft, Wu Dingfu, chairman of the China Insurance Regulatory Commission, said that the provisions of the current insurance law on insurance intermediaries are relatively simple, and there are some gaps in both the subject and the code of conduct.

According to reports, the revised draft clarifies that part-time insurance agency is an important form of insurance agency to solve the problem of unclear legal status of part-time insurance agency; It is clear that insurance assessment institutions are insurance intermediaries, and the registered capital, employees and business rules of their business scope are stipulated; Considering the characteristics of individual insurance agents, the revised draft deletes the provisions in the current insurance law that individual insurance agents should obtain insurance agency business licenses, handle industrial and commercial registration, obtain business licenses, deposit deposits or take out professional liability insurance, and only stipulates that individual insurance agents should meet the qualifications stipulated by the State Council insurance regulatory authorities and obtain qualification certificates; The legitimate business activities of individual insurance agents shall not be investigated and dealt with without a license.

China revises insurance law to crack down on insurance violations

Xinhuanet Beijing, August 25th (Reporter Wu Jingjing, Mao Xiaomei) China’s current insurance law is not perfect in terms of penalties for insurance violations, and there is a lack of penalties for some illegal acts, which makes illegal acts unable to get due sanctions. The revised draft of the Insurance Law, which was reviewed at the fourth session of the 11th the National People’s Congress Standing Committee (NPCSC) on 25th, further clarified the legal responsibilities and cracked down on insurance violations.

Wu Dingfu, chairman of the China Insurance Regulatory Commission, said that with the continuous development of the insurance market, on the one hand, it is necessary to provide corresponding penalties for some new insurance violations, and on the other hand, it is necessary to improve the penalties in the existing insurance law.

The revised draft of the insurance law has increased the punishment for new illegal acts. New illegal acts mainly include illegal appointment of directors, supervisors and senior managers; Insurance companies and their staff make false claims by means of fictitious contracts to defraud insurance money or other illegitimate interests; Lease, lend, alter or transfer the business license; Insurance companies and their staff engage in related party transactions in violation of regulations, fail to disclose information in accordance with regulations, fabricate and spread false facts, etc., which damage the business reputation of competitors and disrupt the order of the insurance market; Insurance companies and their staff misappropriate and occupy insurance premiums and use insurance intermediaries to engage in illegal acts; Insurance intermediaries conceal important information related to insurance contracts, force, induce or restrict the insured to conclude insurance contracts by improper means, and fail to pay insurance money or take out professional liability insurance in accordance with regulations; Foreign insurance institutions set up representative offices in China without approval to engage in insurance business.

The revised draft also increases the accountability of those responsible for illegal acts, and stipulates that insurance companies, insurance asset management companies and insurance intermediaries engage in illegal activities. In addition to punishing illegal institutions, insurance regulators can also take measures such as canceling their qualifications and implementing market bans for their directly responsible directors, supervisors and senior managers. Insurance salesmen, personal agents and employees of insurance intermediaries who violate the law can be warned, fined, their qualification certificates revoked and banned from the market.

In view of the actual situation of various economic sectors investing in the insurance industry, in order to prevent investors from using insurance companies as financing tools, the revised draft draws lessons from the legislation of other countries and regions, and stipulates that if an insurance company’s assets are insufficient to pay off its debts due to its illegal operation, its directors, supervisors, general manager and deputy general manager responsible for deciding the business shall be jointly and severally liable to the company’s creditors.

On the basis of the current insurance law, the revised draft increases the restrictions on the administrative behavior of insurance supervisors, and stipulates the corresponding legal responsibilities for the illegal acts of supervisors in approving institutions, approving insurance clauses and rates, conducting on-site inspections and taking compulsory measures.

China revises insurance law and strengthens self-discipline management of insurance industry.

Xinhua News Agency, Beijing, August 25th (Reporter Wu Jingjing, Mao Xiaomei) A chapter "Insurance Industry Association" was added to the revised draft of the Insurance Law, which was deliberated at the fourth session of the 11th the National People’s Congress Standing Committee (NPCSC) on August 25th, and the legal status and main responsibilities of insurance industry associations were stipulated.

"In order to promote the transformation of government management functions, improve insurance supervision methods and make effective use of supervision resources, we should give full play to the role of insurance industry associations as a self-regulatory organization." Wu Dingfu, chairman of China Insurance Regulatory Commission, said. The revised draft stipulates that the insurance industry association is a self-regulatory organization of the insurance industry and a social group legal person. An insurance company shall join an insurance industry association. Insurance agents, insurance brokers and insurance assessment institutions may join insurance industry associations.

The revised draft also stipulates the responsibilities that insurance industry associations should perform, including safeguarding the legitimate rights and interests of members in accordance with the law and reflecting the suggestions and requirements of members to insurance supervision and management institutions; To mediate disputes between members, members and policyholders, insured and beneficiaries; Members who violate the articles of association of the insurance industry association and the self-discipline rules of the industry shall be given disciplinary sanctions in accordance with the regulations. (End)

The amendment of insurance law intends to improve the market exit mechanism of insurance companies

Xinhuanet Beijing, August 25th (Reporter Wu Jingjing, Mao Xiaomei) The revised draft of the Insurance Law, which was deliberated at the fourth session of the 11th the National People’s Congress Standing Committee (NPCSC) on the 25th, further improved the market withdrawal mechanism of insurance companies.

The current insurance law has made some provisions on the cancellation and bankruptcy of insurance companies. In order to maintain the order of the insurance market and public interests, the revised draft, on the basis of the existing provisions, adds provisions that insurance companies have illegal operations, poor management or solvency lower than the standards set by the State Council insurance regulatory agencies. If the insurance company is not revoked, it will seriously endanger the order of the insurance market and damage the public interests. The insurance regulatory agency of the State Council will revoke it and organize a liquidation team in time to conduct liquidation according to law.

According to the relevant provisions of the Enterprise Bankruptcy Law, the revised draft also provides for special matters concerning the bankruptcy of insurance companies, mainly including: stipulating that the State Council insurance regulatory agencies can apply to the people’s court for reorganization or bankruptcy liquidation of insurance companies; The order of debt settlement in bankruptcy liquidation of insurance companies is further clarified.

Editor: Meng Xu

作者:高惺惟(中央党校〔国家行政学院〕习近平新时代中国特色社会主义思想研究中心研究员)

日前召开的中央金融工作会议指出,“金融是国民经济的血脉,是国家核心竞争力的重要组成部分,要加快建设金融强国”。我国金融正处在由“大”到“强”的关键时期,机遇与挑战并存。建设金融强国,必须坚持和加强党的全面领导,坚定不移走中国特色金融发展之路,推动我国金融高质量发展。

1.金融是国民经济的血脉和国家核心竞争力的重要组成部分

习近平总书记指出:“金融活,经济活;金融稳,经济稳。经济兴,金融兴;经济强,金融强。经济是肌体,金融是血脉,两者共生共荣。”党的二十大报告指出,“高质量发展是全面建设社会主义现代化国家的首要任务。发展是党执政兴国的第一要务”。金融是现代经济的核心,能够通过发挥配置资源的功能助推一国生产力发展、经济腾飞、科技创新和产业升级,是国家重要的核心竞争力。加快建设金融强国,是我国经济社会发展的需要,也是我国经济长远发展的战略抉择,更是在金融全球化进程中维护国家金融安全的需要,事关国家繁荣富强、社会和谐稳定、人民幸福安康。全面建成社会主义现代化强国需要建设一个金融强国。

Finance is the blood that nourishes the body of the economy, and it is a symbiotic relationship with the real economy. The development of finance depends on the real economy, and the development of the real economy needs the empowerment of financial services. Specifically, financial institutions can provide necessary financial support for the real economy, thus promoting the development of the real economy. Finance can enlarge the production capacity and market space of start-ups and prolong the energy storage time of new technologies. By building a modern financial institution and market system, diversified financial services can guide more resources into new fields and new tracks, which is conducive to the accumulation of new kinetic energy in the real economy. All work in the financial sector actively serves the implementation of major national strategies, and can continuously inject "flowing water" into the implementation of relevant strategies by optimizing the allocation of financial resources in rural revitalization, scientific and technological innovation, small and micro enterprises, green development and other fields, adding new vitality to the high-quality development of the economy and society. Finance is an important tool to stabilize macroeconomic operation. By strengthening policy implementation and work promotion and maintaining reasonable and abundant liquidity, the cost of social financing can be effectively reduced, thus stabilizing the market expectation of the real economy and providing a good financial environment for economic and social development.

Finance is an important core competitiveness of a country, financial system is an important basic system in economic and social development, and financial security is an important content of national security. Since its birth, the Communist Party of China (CPC) has recognized the importance of finance, attached great importance to financial work, and ensured the financial cause to move in the right direction. From supporting the revolutionary war, to establishing a new regime, and then to serving the socialist modernization, the financial industry has achieved leap-forward development again and again. Since the 18th National Congress of the Communist Party of China, under the centralized and unified leadership of the CPC Central Committee, China’s high-quality financial development has made new major achievements, the financial system has been continuously improved, and financial supervision has been improved, which has effectively supported the overall economic and social development in the new era and made important contributions to building a well-off society in an all-round way as scheduled and achieving the goal of the first century. In the new era and new journey, Chinese modernization will comprehensively promote the construction of a strong country and the great cause of national rejuvenation. We must speed up the construction of a financial power, comprehensively strengthen financial supervision, improve the financial system, optimize financial services, guard against and resolve risks, unswervingly follow the road of financial development with China characteristics, and promote the high-quality development of China’s finance.

2. The inherent requirements of a socialist modern financial power

The first is people’s nature. "People’s interests first" is the value pursuit of China’s financial work. If finance does not serve the interests of the country and the people, there will be chaos in the financial field. Financial work must adhere to the people-centered value orientation, the fundamental purpose of financial services to the real economy, the eternal theme of financial work, the deepening of structural reform on the financial supply side, the overall planning of financial opening and security, and the general tone of striving for progress while maintaining stability. This requires the financial work to practice the Party’s purpose, the financial system to improve its political position, adhere to political principles, firm its political direction and maintain its political strength, and always bear in mind that the Party’s purpose is to serve the people wholeheartedly, and the people’s position is the fundamental position of the Party and the fundamental position of the financial work led by the Party.

The second is marketization. The central financial work conference pointed out that "we should persist in promoting financial innovation and development on the track of marketization and rule of law". Market economy is essentially an economy in which the market determines the allocation of resources. Practice has proved that the allocation of resources by the market is the most efficient way of resource allocation. To improve the level of market-oriented allocation of financial resources, on the one hand, we must vigorously develop the capital market, optimize the financing structure, and give full play to the hub function of the capital market. The development degree of capital market represents the development degree of financial marketization in a certain sense, and it is the most dynamic platform in the financial system. Developing capital market plays a key role in building a modern economic system. On the other hand, we should steadily promote the reform of interest rate marketization, so that interest rates can give full play to the role of guiding resource allocation. Steadily promoting interest rate marketization is one of the core contents of improving macro-control and deepening financial reform in China, and the interest rate marketization reform can play a vital role in the efficient allocation of funds.

The third is internationalization. Adhere to both "bringing in" and "going out", steadily expand the institutional opening of the financial sector, enhance the facilitation of cross-border investment and financing, attract more foreign-funded financial institutions and long-term capital to develop their businesses in China, and serve the construction of the "Belt and Road". To this end, it is necessary to further optimize the business environment, continue to significantly reduce the restrictions on foreign investment access, create a new platform for international cooperation, provide global investors with a stable investment place under the rule of law, and strive to become the first choice for foreign enterprises to invest. Adhere to the overall planning of financial opening and security, and strive to promote high-level financial opening. High-level financial openness requires steady and prudent internationalization of RMB, which will help enterprises to guard against the risk of liquidity shortage, realize the stability of global foreign exchange reserves, and make RMB an "anchor currency", which is the need of rebalancing global economic development.

The fourth is technology. The financial industry is an information-intensive industry, and information is very important to the financial industry. According to the theory of financial intermediary, financial intermediary has the function of information production, which can provide information to the market and alleviate the information asymmetry between the two parties. Due to the advantages of network in information production and transmission, financial technology not only speeds up information transmission, but also improves the ability of information collection and reduces the cost of information processing, thus improving the information production ability of financial intermediaries. At present, the network has become a platform for human beings to create and share information, and the traditional information dissemination mode is undergoing essential changes under the promotion of network information technology. Financial technology promotes the integration of electronic information technology and traditional finance, innovates the financial format, increases the convenience of financial services, and improves the quality of financial services to the real economy in many fields.

The fifth is inclusiveness. The purpose of inclusive finance is to enable everyone to get financial services at the right price in a timely and dignified manner when they need them. Inclusive finance is consistent with the development concept of "sharing". The economic value of inclusive finance lies in helping to adjust the imbalance between supply and demand of finance, especially the imbalance between supply and demand of financial structure, so that finance can better serve the real economy. The social value of inclusive finance lies in helping low-income people and small and micro enterprises to obtain financial services, so that everyone can have the right to enjoy financial services fairly. In essence, inclusive finance helps low-income groups and small and micro enterprises get the right to get rich through fair development, which can promote inclusive economic growth and harmonious social development.

The sixth is security. The Central Financial Work Conference called for "strengthening financial supervision in an all-round way and effectively preventing and resolving financial risks". Preventing financial risks and maintaining financial security are the eternal themes of financial work. Financial markets and financial institutions must be supervised according to law in order to better guard against financial risks and safeguard the interests of investors. Financial institutions are different from ordinary enterprises, and once something goes wrong, it may lead to systemic risks. The financial industry has strong publicity, externality and sociality, and financial risks are highly contagious and hidden, which requires that financial supervision must be strict, "measuring to the end with a ruler".

3. Promote the construction of a strong financial country with structural reform on the financial supply side.

Over the past 40 years, China’s financial system has been continuously improved in the reform. To build a strong financial country, we must continue to rely on reform, especially deepen the structural reform of the financial supply side, improve the financial market, financial institutions and financial product systems by optimizing the financial structure, clarify the market-oriented objectives and strengthen the responsibility of supervision, and keep the bottom line that systematic financial risks do not occur.

Give full play to the function of the capital market hub. For a long time, China mainly relied on the indirect financing system dominated by banks, which led to a high leverage ratio of enterprises and increased financial risks to some extent. Therefore, it is necessary to further improve the financial market structure, enlarge and strengthen the capital market, build a standardized, transparent, open, dynamic and resilient capital market, and increase the proportion of direct financing. At the critical stage of China’s economy from high-speed growth to high-quality development, the capital market will play a central role in adjusting the industrial structure and building an innovative economic system. Since the reform and opening up, China’s capital market construction has made great progress, but it still faces the problems of low efficiency and imperfect mechanism. To further improve the capital market in the new period, on the one hand, let the capital market play a decisive role in resource allocation. We will promote the deepening of the stock issuance registration system, develop diversified equity financing, vigorously improve the quality of listed companies, and cultivate first-class investment banks and institutions. On the other hand, better play the role of the government. The regulatory authorities maintain the fairness and transparency of the market, resolutely crack down on illegal activities such as market manipulation, insider trading and false information disclosure, and pay more attention to protecting the interests of investors.

Steadily and prudently promote the internationalization of RMB. As long as China’s economy can maintain a high-quality growth momentum, RMB internationalization will be realized stably. In this process, it is necessary to cultivate high-quality development and high-level open microeconomic entities, with the focus on improving the competitiveness of enterprises and products. In addition, we will unswervingly deepen reform and opening up in the financial sector. In the future, the interest rate and exchange rate of RMB should be determined by the market, and the opening of capital account and financial market should be promoted step by step under the principle of efficiency, stability and effectiveness, so that offshore RMB can have a better investment place. Improve the infrastructure construction of RMB internationalization, and strive to realize the services of RMB cross-border payment system (CIPS) wherever there is RMB.

Build a modern central banking system and always maintain the stability of monetary policy. The independence of the central bank is an important part of the modern central banking system. We should strive to create a good monetary and financial environment, always maintain the stability of monetary policy, pay more attention to cross-cycle and countercyclical adjustment, and enrich the monetary policy toolbox. At present, the main goal of unblocking the transmission mechanism of monetary policy is to establish the transmission mechanism of price-based monetary policy by deepening the interest rate marketization reform, taking the loan market quotation rate (LPR) indirectly regulated by the central bank as the operational goal of monetary policy, taking the deposit and loan interest rate of financial institutions determined by market supply and demand as the intermediate goal of monetary policy, and keeping the currency stable and promoting economic growth as the ultimate goal of monetary policy.

Adhere to the implementation of inclusive finance. An important part of promoting the structural reform of the financial supply side is to build a multi-level, wide-coverage and differentiated banking system. In this system, commercial banks, policy banks, city commercial banks, rural financial institutions, private banks and village banks have their own positions, perform their duties and complement each other. State-owned commercial banks should define their position, take the establishment of modern enterprise system as the guide, and keep a close eye on the core goal of "becoming stronger, better and bigger". Policy banks should clearly define their functions, clarify their business boundaries, and take national interests and national strategic needs as their business values. Their main role is to make up for market failures in some areas and do things that commercial banks are unwilling to do, cannot do and cannot do well. Rural commercial banks can better serve small and medium-sized enterprises by relying on the long-term accumulated local credit and its flexible interest rate policy. They should identify their own differentiated positioning, establish business priorities, pay attention to meeting the differentiated, personalized and customized business needs of "agriculture, rural areas and farmers" and small and medium-sized enterprises, and "do small things" to reduce the loan concentration and the loan scale per household.

Comprehensively strengthen financial supervision and effectively prevent and resolve financial risks. Comprehensively strengthen institutional supervision, behavioral supervision, functional supervision, penetrating supervision and continuous supervision, eliminate regulatory gaps and blind spots, and better safeguard financial security. First, improve the modern financial enterprise system with China characteristics, improve the management of state-owned financial capital, broaden the channels for bank capital replenishment, and do a good job in risk isolation between industry and finance. Early identification, early warning, early exposure and early disposal of risks, sound early correction mechanism of financial risks with hard constraints, and timely disposal of risks of small and medium-sized financial institutions. The second is to establish a long-term mechanism to prevent and resolve local debt risks, establish a government debt management mechanism that is compatible with high-quality development, and optimize the debt structure of central and local governments. The third is to prevent financial risks caused by the real estate market. Promote a virtuous circle between finance and real estate, improve the main supervision system and fund supervision of real estate enterprises, improve macro-prudential management of real estate finance, and meet the reasonable financing needs of real estate enterprises with different ownership equally. The fourth is to strengthen the supervision of financial technology. The rapid development of financial technology has enhanced the concealment of financial risks, added many new financial risk points, and put forward higher requirements for the ability of financial supervision. Therefore, financial supervision departments need to innovate financial supervision means and balance the relationship between financial innovation and financial security, so as to encourage financial innovation that will help improve the efficiency of financial services and control financial risks within a safe range.

Guangming Daily (November 10, 2023, 06 edition)

CCTV News: Huang Xintong is a flower skater in China. He once won the national championship in 2006-07 season, the fifth place among university students in the world, the second place in the Asian Winter Games, the eighth place in the four continents flower skating championships, the 21st place in the 2007 World Championships and the final champion of the 11th Winter Games. The picture shows Huang Xinyi’s exquisite and beautiful photo.

|

Exquisite photo of ice dancing beauty, youthful beauty is full of beautiful style.

|

Exquisite photo of ice dancing beauty, youthful beauty is full of beautiful style.

A few days ago, the Office of Anxi County Tea Industry Management Committee released the announcement on the implementation of the first "China Tea Cup" Anxi Tea Packaging Design Competition, and officially launched the collection of the competition works.

The first "China Tea Cup" Anxi Tea Packaging Design Competition was guided by China Tea Circulation Association, Tsinghua University Academy of Fine Arts Brand Authorized ip Design Institute and Cross-Strait Tea Exchange Association, hosted by Anxi County People’s Government, and undertaken by Anxi County Tea Management Committee Office, Anxi County Tea Development Center, Anxi County Industrial Information and Commerce Bureau, Quanzhou Industrial Design Association and Anxi County Tea Development Promotion Association. With the theme of "breaking the boundary and imagining the future", the contest aims to empower Anxi tea packaging with new images and new ideas, respond to the national standard "Restricting over-packaging of commodities requires food and cosmetics" (GB23350-2021) implemented on September 1, 2023, guide the vast number of tea enterprises and packaging enterprises to adapt to the new standards as soon as possible, further improve the innovation and standardization of Anxi tea packaging, and also provide for enterprises and design talents.

The contest has the following two major tracks:

Anxi Tieguanyin packaging design: Based on Anxi Tieguanyin tea, a set of exclusive packaging of Anxi Tieguanyin tea was created according to its tea characteristics, brand positioning and cultural connotation.

Hundred teas packaging design: This direction is not limited to tea varieties, and can cover any tea varieties such as black tea, oolong tea, black tea and white tea. In order to meet the development needs of tea packaging industry and the management of new standards, a number of innovative, marketable and scientific new packaging were collected.

The total prize money of the contest is 191,000 yuan, of which the highest prize money in a single event is 30,000 yuan. The competition works are designed around six innovative points: appearance, structure, brand, culture, environmental protection and technology. The collection time is from December 2023 to February 20, 2024. Now we are collecting works for enterprises, design institutions, colleges, individuals or teams at home and abroad.

Goodbye 2023

Hello 2024

New Year’s Day holiday travel "craze"

I’m rushing here.

Here is a travel tip.

Please check

↓↓↓

New Year’s Day in 2024 is coming, and there will be more short-distance trips to go on road trip, friends’ gatherings and home visits, which will also increase the road traffic pressure. Here, we remind the traffic participants to know the road conditions in advance, choose the travel time, route and mode reasonably, avoid the rush hour and traffic jam-prone sections, drive carefully and travel safely.

Holiday arrangement

HAPPY NEW YEAR

one

two

three

four

five

six

sun

25

Christmas

26

fourteen

27

fifteen

28

sixteen

29

seventeen

30

have a holiday/vacation

31

have a holiday/vacation

one

New Year’s Day

2

Twenty one

three

Twenty two

four

Twenty three

five

Niansi

six

Minor Cold

seven

Twenty six

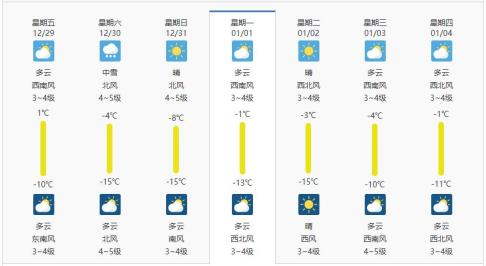

Holiday time: from December 30, 2023 to January 1, 2024, a total of 3 days. In addition, highway traffic is not free during New Year’s Day, please note, no! Free! Fee!

Weather conditions

HAPPY NEW YEAR

When driving in winter, pay attention to the weather information, freeze the foggy weather, do a good job of anti-skid in advance, slow down and keep a safe distance, do not overspeed, overload or overload, and it is strictly forbidden to drive without a license and fatigue.

Traffic flow prediction

HAPPY NEW YEAR

1. The traffic congestion pressure in the business circle will increase. At present, the theme activities of major supermarkets and entertainment venues for New Year’s Day are being vigorously carried out, and shopping, catering, entertainment and other activities are further increased during the holiday period. During the lunch and evening meals, there will be a phenomenon of slow traffic around some business districts.

2. The risk of rural road traffic safety has increased. During the New Year’s Day, it is winter, and rural areas enter the winter break and leisure time. With the approach of the New Year’s Day, people’s activities of purchasing new year’s goods are increasing day by day, and the road markets of provincial highways and counties in some countries are more prosperous, so traffic accidents are prone to occur when vehicles pass through the relevant sections of the market.

Driving tips for New Year’s Day holiday

HAPPY NEW YEAR

1. During the New Year’s Day, please try to take public transport and take the vehicle at the regular passenger station. Do not intercept the vehicle outside the station or beside the expressway, and refuse to take illegally operated and overcrowded vehicles.

2. Please pay close attention to the traffic information and traffic safety tips, understand the road conditions, easy-to-block sections and bypass routes along the way, plan the travel time and routes in advance, and try to avoid the travel peak. In case of heavy road traffic and traffic congestion, please wait patiently and queue up in turn.

3. Fatigue driving will lead to poor judgment and slow response, and increase the risk of operational errors. Please arrange the rest time reasonably to ensure adequate sleep, drive continuously for no more than 4 hours, and stop for no less than 20 minutes. If you feel sleepy and in poor condition, please choose a safe place to stop and rest.

4. When you return to your hometown on New Year’s Day, your family will be reunited and you should drink moderately. Drinking alcohol leads to slow response and slow action, and the driver’s ability to control the vehicle decreases. For the safety of you and others, don’t drink and drive!

5. When the vehicle has a minor property traffic accident, please move the vehicle to the side of the road after taking photos to fix the evidence, set a warning sign 150 meters away from the incoming direction, turn on the danger warning light, and call the police in time. Drivers and passengers should leave the vehicle and the road to avoid secondary accidents.

Original title: "Important reminder │ related to New Year’s Day travel! 》

Read the original text

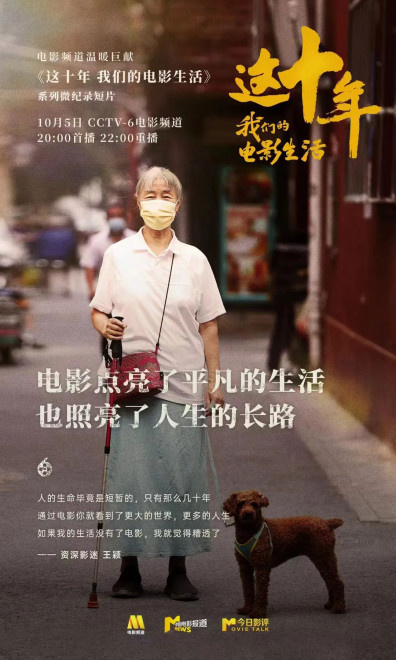

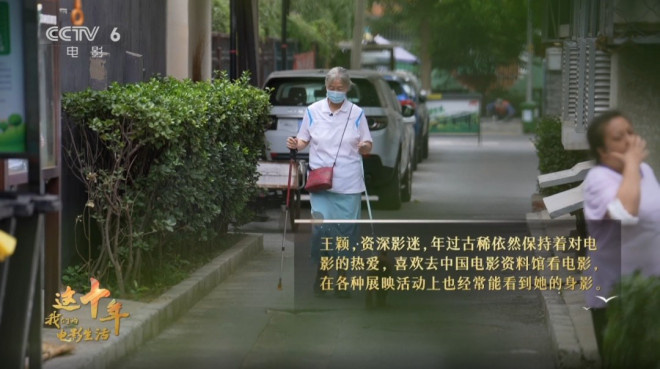

Special feature of 1905 film network In this decade, from fireworks to prosperity in the world, movies have always been in our lives. This decade, the film is life, life is film, this decade, our film life.

"After all, life is short. It’s only a few decades. It’s impossible to see all countries and all parts of the world, but through movies, we have seen a bigger world and more lives. If there is no movie in life, I feel terrible. "

In the past ten years, filmmakers’ views on movies have gone from far to near. The biggest change that movies have brought to her is to unconsciously grasp the place where she can empathize as an actor in the future: "I think movies have made me more real and richer as a person." The feeling of my first filming was first of all, and secondly, I tried my best to take care of what was in front of me first, but I couldn’t think of the future. "

From the beginning, Lang Yueting’s acting career can be described as a newborn calf who is not afraid of tigers and dares to challenge: "For me, I think maybe I can only shoot this scene in my life, and then there will be no future development as an actor. I always think so."

This movie is a difficult one for Lang Yueting. She doesn’t know how to prepare the role and how to play it well. During that time, every day in her mind, she thought about what the character’s childhood was like and how she came over as a teenager. Such brainstorming made her sleep badly every day: "This is a particularly good help for me. In fact, Hongxia can’t sleep well every day, so she tries her best to be close to her state psychologically. I didn’t know that there was a word called biographies, but I was very pleased to know that I was really doing this. "

It is precisely because of the jitters and treading on thin ice in the first two plays that Lang Yueting was afraid to define the job as an actor for herself from the beginning, and later she could naturally introduce: Hello, everyone, I am an actor Lang Yueting. But it didn’t take long for the film to make her so worried again that she didn’t know how to start, because she had never played a real story. In the past, she could make the fictional character close to herself or find something in common with the character, but in reality, she couldn’t find something in common with Huang Wenxiu: "After the role was played, I recorded a program in which I talked about a lot of knowledge about planting kiwifruit and picking sugar oranges. This is something I really knew. Huang Wenxiu had to find out at that time because he wanted to develop a rich industry for the village."

Wang Ying, a veteran movie fan, has been married in Beijing for almost fifty years. When her family first moved here, the reputation of the China Film Archive was not as loud as it is now. Occasionally, acquaintances and friends sent tickets to her, so she would go and have a look. Wang Ying’s children are engaged in the mobile communication industry, and they will urge Wang Ying and his wife to learn smart phones, so as not to be eliminated by history. When Wang Ying went to the China Film Archive to buy tickets in the previous way, the movie tickets for classic films had been robbed by fans online. She could only queue up at the window for two hours and buy two movie tickets: "I thought, no, I have to learn smart phones. Later, I began to learn how to grab tickets online. I saw it a few days ago and bought a Huimin ticket for ten yuan. I didn’t expect the effect to be so good. "

As a policeman, Wang Ying felt heartfelt admiration for the actors when she watched "Fight Against the Black", and their interpretation of the police made her feel good after reading it. Besides watching movies on the spot, Wang Ying has also experienced the Cloud Cinema. She can enjoy watching movies at home with a little finger flick, but she is a bit nostalgic and prefers to go to the cinema to enjoy her favorite movies. Wang Ying went to the cinema to support her favorite movies, while her lover silently supported her hobbies behind her back. When watching movies in Wang Ying, the dog ball at home was taken care of by her lover, and cooking became his job. Living in such an environment with love and a big screen, when Wang Ying was chatting with his neighbors, the topic could not be separated from movies.

随着这些年的飞速发展,附近的设施越来越现代化,王颖非常喜欢中国电影资料馆的音响效果,她每次都会买同一个位置,在影院的最角落里,每坐一个小时,她可以出去歇一会儿,角落里的位置进出方便,也不会影响到他人观影。作为一名影迷,王颖将自己对于电影的爱意贯彻到了方方面面,也因为这份爱,她不断随着社会发展而学习、充实自己。电影丰富了王颖的生活,陪伴她与各个创作者们对话。

对于大银幕内外的王颖与郎月婷,电影都是一件她们热爱、奋斗过的事物。这十年来,电影让中国的观众又哭又笑,在不知不觉中,电影早已与我们的生活融为一体了。感谢遇见电影,能在有限的生命中拓宽了我们生命的宽度;感恩电影,带给我们生活如此多的奇妙与温馨。

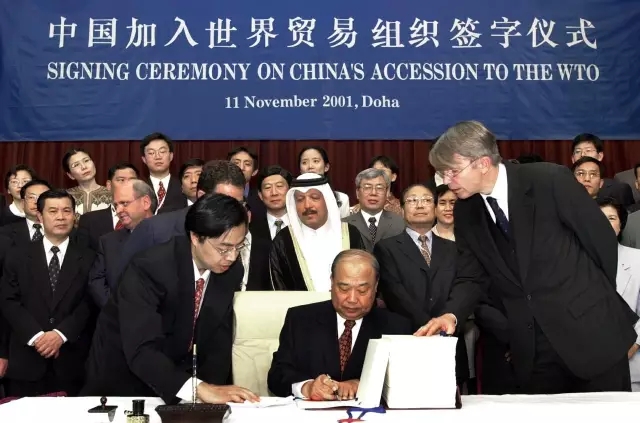

CCTV News:Today is the 15th anniversary of China’s accession to the WTO. In the past 15 years, what impact has China’s entry into WTO brought to China’s economic development? What does China’s entry mean to the world economic and trade system?

On November 11th, 2001, in Doha, Qatar, Shi Guangsheng, then Minister of Foreign Trade and Economic Cooperation of China, signed on behalf of the China government at the ceremony of China’s accession to the WTO.

Great changes have taken place in China itself and even in the world since its entry into WTO 15 years ago.

Looking back on the past 15 years, China has made great progress in economic development, system construction and participation in international governance, but at the same time, it also needs to face up to the problems such as the increase of trade friction caused by changes in external environment.

First of all, by joining the WTO and connecting with the world, China’s economy will grow under the global competition.

On the eve of China’s entry into WTO, China is the sixth largest economy in the world. Now, China has become the world’s second largest economy, the largest trader of goods, and the second largest foreign investor, with a per capita GDP of nearly 8,000 US dollars. This series of achievements can directly prove China’s great progress since its entry into WTO.

Entering WTO is an important step for China to integrate into the world market, which is conducive to attracting foreign investment, promoting exports and promoting economic development. Therefore, the membership of WTO is called the stabilizer and accelerometer of China’s economic take-off. In the process of China becoming the world’s factory, China enterprises have also learned to better coordinate the domestic and international situations, make better use of the two markets and resources, and enhance new development momentum, add new impetus to reform and create new competitive advantages in the opening up.

Secondly, after China’s entry into WTO, the development of China has benefited the whole world and achieved a win-win situation.

After China’s entry into WTO, China has not only realized its own development, but also brought more development opportunities to the world. Lamy, former Director-General of WTO, once commented that China’s entry into WTO has brought great changes to world trade, and many countries have also gained a lot with China. For example, US exports to China increased from $19 billion in 2001 to $116.1 billion in 2015; The trade volume between China and Africa increased from 10.8 billion US dollars in 2001 to 179 billion US dollars in 2015.

Since China’s entry into WTO, China has been unswervingly opening wider to the outside world and striving for mutual benefit and win-win results. By implementing a firm opening-up strategy and constantly creating a more comprehensive, deeper and more diversified opening-up pattern, China’s total import in 2015 reached US$ 1.68 trillion, creating tens of millions of jobs for its trading partners. At the same time, China’s inexpensive goods have also brought great benefits to foreign consumers. It is worth mentioning that at present, China’s contribution rate to world economic growth is more than one quarter, and it has been the biggest engine of global economic growth for many years.

Third, with the gradual deepening of economic and trade ties with the world, China no longer passively accepts the international economic and trade framework, but begins to actively participate in the formulation of rules.

Since China’s entry into WTO, the economic and trade interaction between China and the outside world has continued to deepen. At first, China could only passively adapt to the terms of international trade. Today, China’s position in world trade has been on a par with that of the United States and Europe. Especially after the financial crisis in 2008, China has made the greatest contribution to global economic growth, which also highlights the importance of China in the global trade pattern. China has begun to actively promote the construction of a more just and reasonable international order, including trade order.

China is a participant, contributor and builder in the world trade system. The construction of the "the belt and road initiative" initiative is the "China Program" to promote global development cooperation. This program does not replace the existing cooperation mechanism, does not challenge the existing international economic system, and is a useful supplement and improvement to the existing international mechanism. The goal is to achieve common development and is committed to promoting countries to expand mutual market opening and trade and investment facilitation.

The global trade environment has changed, and challenges and opportunities coexist.

On the other hand, we should also see that the international trade environment has changed a lot in the past 15 years. The deep-seated impact of the international financial crisis still exists for a long time, and the external environment is unstable and uncertain, which leads to the weak growth of global economy and trade.

In the first five years of China’s accession to the WTO, the growth rate of global trade was about 1.8 times that of the world economy, but now the growth rate of global trade has been lower than that of the world economy for four consecutive years. Economic globalization has experienced twists and turns, protectionism and inward-looking tendencies have risen, and the multilateral trading system has been hit. This situation poses a new challenge to China’s foreign economic ties. To cope with this situation, China should take the lead in building an open world economy and continue to promote trade and investment liberalization and facilitation.

完成产业升级 迎接新的挑战

全球治理体系在发生着深刻的变革,新技术的发展也在重塑全球贸易的格局。“互联网+”向服务业和制造业全面渗透,新产业、新业态、新商业模式不断涌现,全球产业链、价值链、供应链加速整合,这使得国际产业分工和竞争格局正在发生深刻变化。比如,制造业从发达国家向发展中国家的转移放缓,新兴经济体单纯依靠低劳动力成本优势发展加工型贸易从而完成产业升级的路越走越窄。当前主要大国都在重塑竞争新优势,中国也需要完成产业升级,在未来的国家贸易体系中占据有利地位。

国家主席习近平上个月在APEC工商领导人峰会上提到:“经济全球化符合经济规律,符合各方利益。同时,经济全球化是一把双刃剑,既为全球发展提供强劲动能,也带来一些新情况新挑战,需要认真面对。”在入世15年的时候,对以往做总结,无疑可以让中国在未来更好地适应经济全球化,参与经济全球化,塑造经济全球化。

文丨央视评论特约撰稿 王亚宏