This article Source: Time Finance Author: Zhou Jiabao

"If you want to succeed in China, you have to find a general trend. Find the wind and you can take off with one wing. When the general trend is no longer, even Kun Peng can’t fly. " In April 2023, Ma Xiaoyu, vice president of L ‘Oré al China and general manager of high-end cosmetics department, spoke frankly to Time Finance and other media.

In the past five years, influenced by many factors, such as the awakening of consumer awareness, Internet traffic bonus and the upgrading of economic structure, the beauty industry in China has experienced an unprecedented highlight moment.

Statistics from the National Bureau of Statistics show that from 2018 to 2022, the total retail sales of cosmetics in China increased from 261.9 billion yuan to 393.56 billion yuan. In the first half of 2023, the total retail sales of cosmetics in China increased by 8.6% year-on-year to 207.1 billion yuan, which was more than the total retail sales of cosmetics in 2015.

The rapid expansion of the market has made China the largest overseas market for international beauty groups, and also allowed many local beauty companies to taste the fruits of victory. In 2022, more than 30 domestic beauty companies entered the echelon with annual revenue of 1 billion yuan, and the single-brand revenue scale of head enterprises exceeded 5 billion yuan.

However, it is impossible for any industry to stay in a high-speed growth environment. "This wind in China is in the troposphere." Ma Xiaoyu added that the troposphere, with frequent air movements, indicates the complicated and changeable beauty market environment in China.

When the impact of the epidemic "black swan" has not completely dissipated and the Internet traffic dividend has peaked, this uncertainty has become more and more prominent. Although the development of the industry has matured, the consumer demand has always been difficult to meet expectations. After experiencing a rush from 0 to 1, local beauty began to slow down and enter a cyclical adjustment.

We have seen that domestic beauty companies that have gained market share in the past few years have begun to scramble to get out of the comfort zone. Huaxi Bio, Polaiya, shanghai jahwa and other track head players make new decisions at this crossroads. In the short-term interests and long-term benefits, the latter is chosen to seek a more stable chassis to confront possible opportunities and shocks.

Make up lessons for high growth:Beauty industry long slope seeking snow

Entering the adjustment period does not mean that the fast-moving train suddenly loses its kinetic energy.

In the first half of this year, the achievements of domestic beauty companies were still bright. According to industry media statistics, the total revenue of ten local listed beauty companies, such as Huaxi Bio, Polaiya, Betani, shanghai jahwa and Aimeike, exceeded 22.3 billion yuan in half a year, achieving double-digit growth compared with the same period last year. Among them, the revenue scale of Huaxi Bio and Polaiya exceeded 3 billion yuan, setting a record high.

It is worth noting that the latest performance data reflects two new changes in the domestic beauty industry.

On the one hand, domestic beauty companies began to stage a ranking chase, and the scale of head enterprises continued to grow, but the gap was narrowing. In terms of revenue scale, shanghai jahwa, which owns many skin care brands such as Yuze and herborist, still ranks first with 3.629 billion yuan. At the same time, the latest revenue of Polaiya, a latecomer, reached 3.627 billion yuan, only 2 million yuan behind shanghai jahwa. Huaxi Bio, on the other hand, bit behind with a scale of 3.076 billion yuan. Betani’s 2.368 billion yuan is not far from Shuiyang’s 2.29 billion yuan.

On the other hand, the slowdown in growth has become a fact that most enterprises must face. Although some enterprises achieved double-digit growth in the first half of this year, it is still impossible to rule out the influence of low base under the domestic epidemic control factors in the first half of 2022, and the slowdown trend is more obvious than that in 2021.

First look at the revenue growth rate. From the first half of 2021 to the first half of 2023, the year-on-year growth rate of shanghai jahwa’s revenue decreased from 14.26% to 2.3%. The year-on-year growth rate of Huaxi Bio’s revenue decreased from 104.44% to 4.77%; The year-on-year growth rate of Shuiyang’s revenue dropped from 49.94% to 4%; The year-on-year growth rate of Aimeike’s revenue dropped from 161.87% to 64.93%. Looking at the growth rate of net profit, the year-on-year growth rate of Shuiyang shares in the first half of 2021 was 164.48%, while the growth rate in the first half of this year was 72.02%; Betaine’s net profit growth rate dropped from 65.28% in the first half of 2021 to 13.91% in the same period this year.

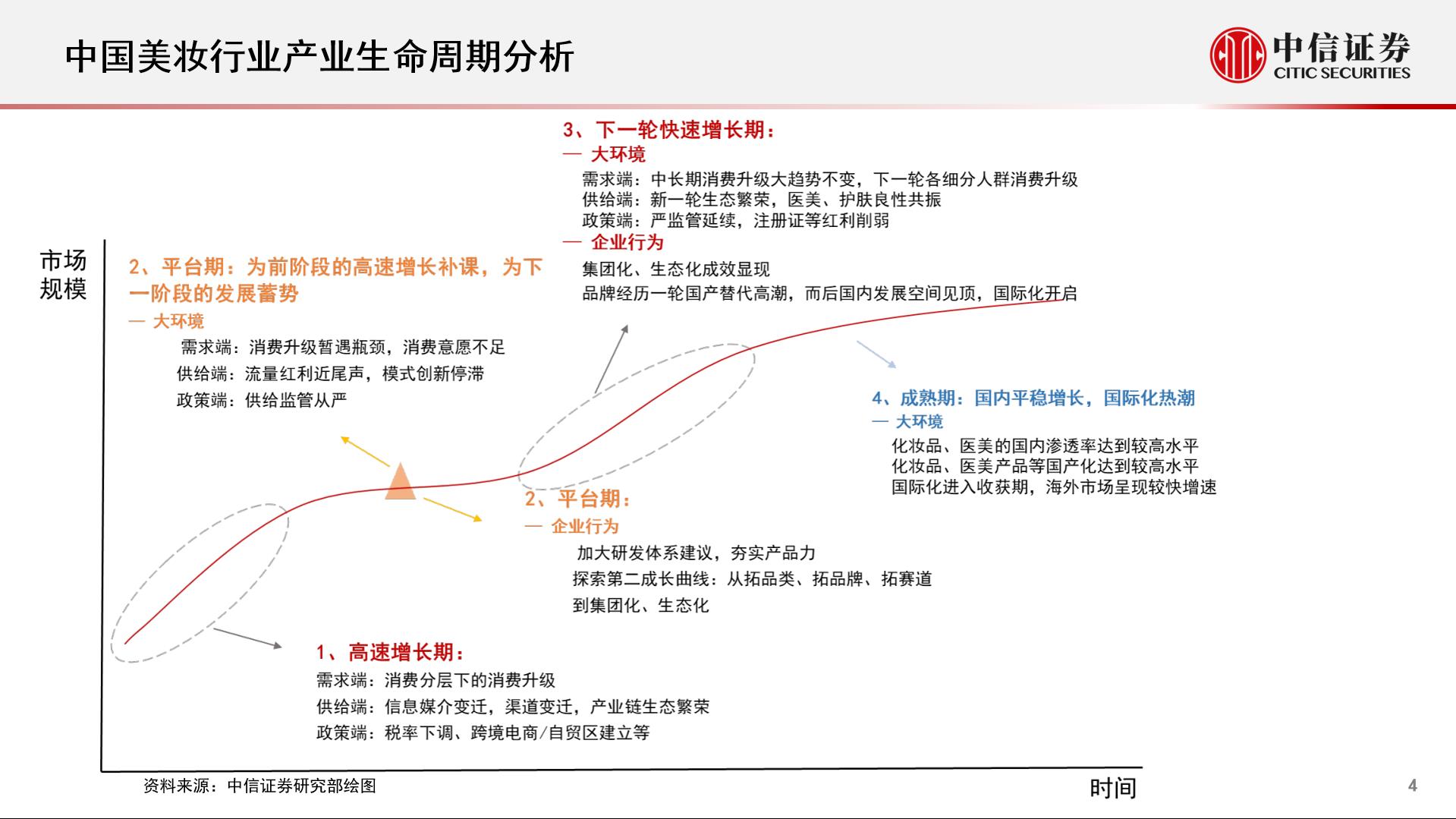

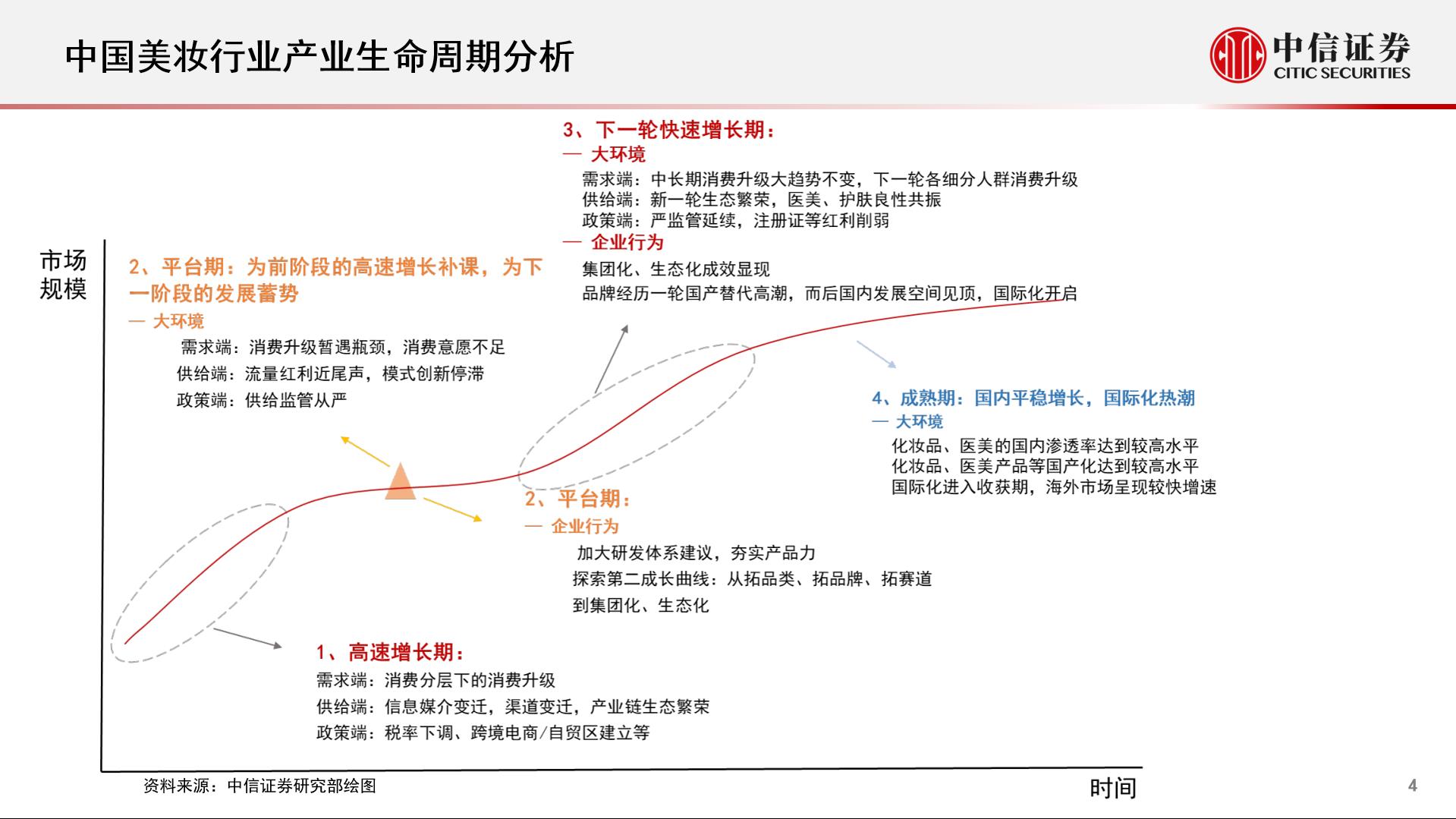

The change is the result of many factors. The research department of CITIC Securities divides the industrial life cycle of China’s beauty industry into four stages: at present, China’s beauty industry has gone through a period of rapid growth and is in a platform period. After that, there will be the next round of rapid growth and maturity. In the platform period, the uncertainty of the environment faced by domestic beauty cosmetics is prominent. This includes the bottleneck of demand-side consumption upgrading and insufficient consumption willingness; The supply-side traffic dividend is coming to an end, and model innovation is stagnant; Policy-side supply supervision is strict.

In addition, Xu Xiaofang, chief analyst of the agency’s beauty and business, also pointed out that after the "618" in 2021, the return on investment in the primary market declined, the investment momentum declined, and the funds in the primary market began to ebb. It is also at this stage that domestic beauty companies have begun to make up lessons for the high growth in the previous stage and gain momentum for the next stage of development.

Huaxi Bio clearly stated in the financial report that the slowdown in growth rate is the result of the company’s initiative to get rid of the past success path dependence and carry out comprehensive reforms.

Huaxi Bio said, "The external traffic dividend is slowing down, the traffic cost is getting higher, and the superimposed internal organizational structure and operation management need to be further upgraded. In the first half of the year, the company thoroughly examined the business health and took the initiative to make strategic adjustments to slow down the development speed."

Xu Li Squat:Endogenous growth sumLongevism

American financial tycoon Soros once said: "I am not afraid of anything, but I am afraid of uncertainty." Uncertainty will aggravate the vulnerability of enterprises and shorten their life.

How do domestic beauty companies cross the cycle in an uncertain environment?

Dongxing Securities Research Report pointed out that the development process of international beauty products has gone through the development stage of "classic products-classic brands-brand matrix", that is, the brand positioning is established with classic products, and the brand establishes enterprise tonality, while the perfect brand matrix becomes the shield for the beauty products to grow continuously through the cycle.

The constant core and underlying logic of these three development stages is still the product. For example, Estee Lauder’s small brown bottle, L ‘Oré al’s Bose water emulsion, Lancome’s small black bottle and other products have firmly occupied consumers’ minds for decades and are still iterating to support the constantly updated brand story.

In the past few years, the remarkable effect of the big single product strategy of domestic beauty companies such as Huaxi Bio and Polaiya has also confirmed this point. Among them, Runbaiyan, the core brand of Huaxi Bio, has achieved a 20-fold growth in the four years since it entered the C-end market. In 2022, Runbaiyan’s single brand revenue will reach 1.385 billion yuan. In addition, its Quadi’s 5D essence, Mibel’s pink water and blue bandage mask, and muscular brown rice water are active in the platform promotion list.

Huaxi Bio-Runbaiyan’s Large Single Product Series

In this context, increasing investment in R&D system construction and consolidating product strength have become the only way for enterprises to cross the cycle.

The R&D investment of domestic beauty companies in the head is constantly increasing. From 2020 to 2022, Huaxi Bio’s R&D expenditure increased from 94 million yuan to 388 million yuan per year, maintaining its leading position in the industry. Bettini’s R&D investment increased from 63 million yuan to 255 million yuan. While Polaiya increased from 72 million yuan to 128 million yuan. In terms of the number of R&D personnel, Huaxi Bio also has an absolute advantage with 827 R&D personnel, with 391 R&D personnel in Betani and 229 in Polaiya respectively.

Compared with the low R&D expense rate of domestic beauty products, the data in the first half of this year gave the industry enough confidence. The data shows that the R&D expense rates of Huaxi Bio and Betani are as high as 6.07% and 4.6% respectively. And Polaiya, shanghai jahwa, giant creature also exceeded 2%. According to the research report of CITIC Jiantou Securities, the R&D expense ratio of international head beauty enterprises is mainly between 1.5% and 3.5%. According to Dongxing Securities, the highest R&D expense ratio of L ‘Oreal is 3.2%.

Behind betting on R&D is the determination of head enterprises to change from "growth to external environment" to "promoting endogenous growth". Xu Xiaofang pointed out, "In the past, local brands were grabbing traffic, doing marketing, and upgrading new products. Now they have begun to strengthen various solid actions such as personnel training and upgrading, and organizational restructuring."

The operation and management of head enterprises are moving towards the era of refinement. Time Finance learned that since 2020, Huaxi’s biological organization structure has been continuously optimized to promote the refined operation of skin care and other businesses. The front desk has clearly defined career lines and business divisions, and established seven major Chinese-Taiwanese empowerment business departments, including R&D, supply chain and brand building. In 2023, the adjustment is still going on, involving business operation management system, organizational function management system and talent ability model. In addition, Polaiya is also implementing a more refined operation management system, supplemented by the self-driven organization construction of "culture-strategy-mechanism-talent". Pan Qiusheng, Chairman and CEO of shanghai jahwa, also revealed in the previous semi-annual performance meeting that the organization is undergoing internal adjustment to improve its operational efficiency.

When long-term doctrine becomes the consensus of the whole industry, the logic of the capital market to look at domestic beauty is also changing.

Pan Jie, director of consumer investment of Lianjie Qichen Capital, pointed out to Time Finance, "In the upward stage of economy, whoever can tell the story of C-end brand well, grasp consumers’ hearts, implant brand minds and establish a moat of values will be able to seize consumers’ purchasing power. At that time, we will pay more attention to the brands that run out of the C-end, and most of them lack supply chain capabilities. However, in the economic downturn, the consumption power of C-end is weak. At this time, the upstream supply chain facing B-end shows its advantages, and we will go upstream to find enterprises with R&D capabilities and production capacity. Many times, these companies are the foundries of former big brands. "

In Pan Jie’s view, enterprises with product R&D and supply chain capabilities are more resilient to growth, which is linked to long-termism. They can not only meet the changing needs of consumers continuously and quickly, but also have stronger resistance to pressure in an uncertain environment.

Domestic beauty "revival":Return of discourse right in local market

At present, the right to speak of domestic beauty cosmetics in China market is gradually returning.

According to Wanlian Securities, as early as 2021, domestic brands showed the ability to compete with international brands in the market. In 2021, the retail sales of domestic brands in China cosmetics market was 447 billion yuan, while the retail sales of international brands was 500 billion yuan.

In the more specific C-end skin care market, in the past few years, the bioactive components on the fermentation platform such as hyaluronic acid, γ-aminobutyric acid and ergothionine of Huaxi Bio, ergothionine, peptide, alcohol A of Polaiya, and plant active components of Betanie with Yunnan characteristics have made consumers aware of the advanced technology of domestic cosmetics.

Domestic enterprises headed by Huaxi Bio, Betani and Polaiya are also breaking through the monopoly of foreign giants, especially in the field of functional skin care. According to the data of Jost Sullivan in 2021, the concentration of head enterprises in the market structure of functional skin care products in China reached 67.5%. Among them, Huaxi Bio-market accounted for 11.6%; The market share of the two major beauty groups from Japan and France is 10.06% and 12.4% respectively.

Although the growth of cosmetics market in China is slowing down, the scale of cosmetics market in China still ranks second in the world, and its growth rate is ahead of the world, which provides an opportunity for China beauty enterprises to "overtake in corners".

According to Jost Sullivan’s data, the compound annual growth rate of cosmetics market in China is 12.0% from 2015 to 2021, while the compound annual growth rate of global cosmetics market is only 2.2% in the same period. According to the research, the cosmetic market in China will reach 1.48 trillion yuan in 2026.

Pan Jie believes that for domestic beauty companies, the next opportunity is still in functional skin care and high-end beauty track. According to Jost Sullivan, from 2022 to 2027, the compound annual growth rate of functional skin care products market in China may be as high as 38.8%. "Most of the international brands that supply the domestic market are produced in China. Domestic beauty companies, especially those that come from raw materials, have greater advantages in the production, efficiency and cost of core components. Research and development of this piece must adhere to long-term. " Pan Jie said.

According to the analysis of Dongxing Securities, China has been in the international leading position in the fields of synthetic biological preparation of recombinant collagen, rare ginseng and saponin. Domestic brands began mass production of recombinant collagen skin care products in 2009 before international brands. It has a strong leading edge in the research and development, production and application of recombinant collagen.

Judging from the concrete results of the enterprise, Huaxi Bio entered the synthetic bio-track in 2018 on the basis of absolute leadership of hyaluronic acid. As of June 30th, Huaxi Bio, which has 121 R&D projects on raw materials and synthetic biology, has achieved rapid iteration of synthetic biological production strains in the first half of the year, and the trial production of recombinant collagen, lipopeptide, enzymatic sialic acid and other products has been completed, and more than 10 products have entered the pilot stage. In the first half of the year, Huaxi Bio listed BioyouthTM-EGTPure ultra-pure ergothionine and HybloomTM micro-truth, which greatly improved the production efficiency.

Huaxi Bio revealed that in the second half of this year, the company’s sterile HA (hyaluronic acid) production line is expected to be officially put into use, further consolidating its leading position in the top-end market of hyaluronic acid. At the same time, Hainan Huaxi Biotechnology Industrial Park (Phase I) will also be officially opened, which will help promote the layout of Huaxi Bio in medical devices, regenerative medicine and international business.

China’s domestic beauty cosmetics have obviously begun to tear off the parity label, and started a war about "leading the future" with international beauty cosmetics.