CCTV News:According to the website of China Consumers Association, on August 2, China Consumers Association released an analysis of complaints received by the National Consumers Association in the first half of 2024. According to the statistics of complaints received by the National Consumers Association, in the first half of 2024, the National Consumers Association accepted 782,794 consumer complaints, up 27.21% year-on-year, and solved 563,346 complaints, with a complaint resolution rate of 71.97%, saving consumers 447.7 million yuan in economic losses. Among them, there were 13,641 complaints of double compensation due to fraudulent behavior of operators, and the amount of double compensation was 730,000 yuan. Received 350,000 visits and consultations from consumers.

First, the basic situation of complaint classification

(A) the nature of the complaint analysis

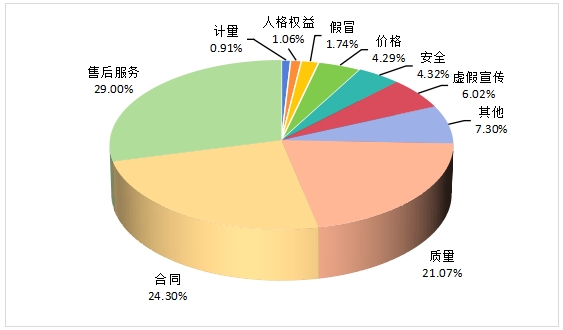

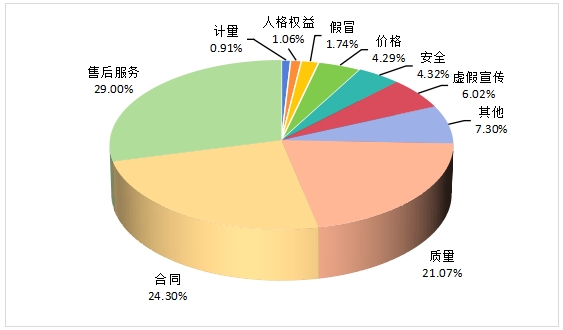

According to the nature of complaints (as shown in Figure 1), after-sales service problems account for 29.00%, contract problems account for 24.30%, quality problems account for 21.07%, false propaganda problems account for 6.02%, safety problems account for 4.32%, price problems account for 4.29%, counterfeiting problems account for 1.74%, personality rights and interests problems account for 1.06%, and measurement problems account for 0.91%.

Figure 1 Proportion Chart of Complaint Nature (%)

Compared with the first half of 2023 (as shown in Table 1), the proportion of complaints about quality, false propaganda and safety issues increased, while the proportion of complaints about after-sales service, price and personal rights and interests decreased.

Table 1 Classification of Complaints by Nature

(B) Category analysis of goods and services

Among all the complaints, there were 356,527 commodity complaints, accounting for 45.55% of the total complaints, which was 7.75 percentage points lower than the same period last year. The number of service complaints was 331,934, accounting for 42.4% of the total complaints, and the proportion decreased by 2.18 percentage points; There were 94,333 other complaints, accounting for 12.05% of the total complaints.

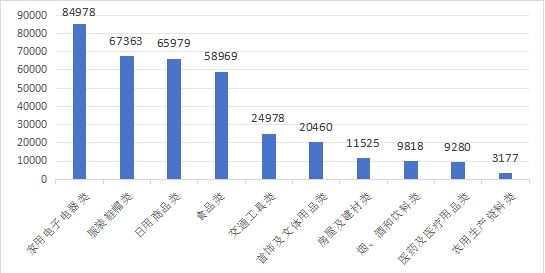

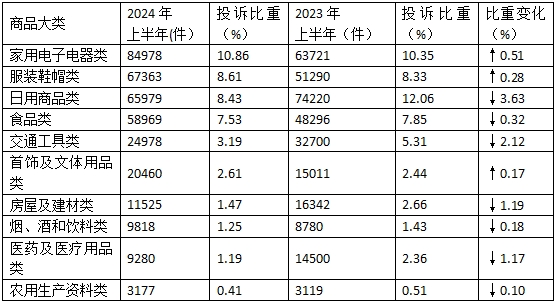

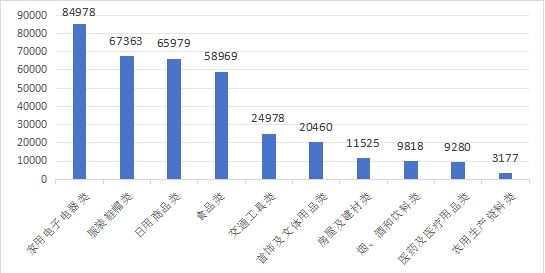

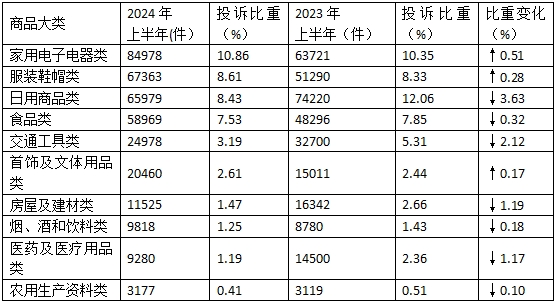

According to the complaint data of commodity categories in the first half of 2024 (as shown in Figure 2 and Table 2), the complaints of household electronic appliances, clothing, shoes and hats, daily commodities, food and transportation are in the top five. Compared with the first half of 2023, the proportion of complaints about household electronic appliances, clothing, shoes and hats, jewelry and stationery increased, while the proportion of complaints about daily commodities, transportation, houses and building materials decreased.

Fig. 2 Complaint volume chart of commodity categories (unit: pieces)

Table 2 Table 2 Changes of Complaints in Commodity Categories

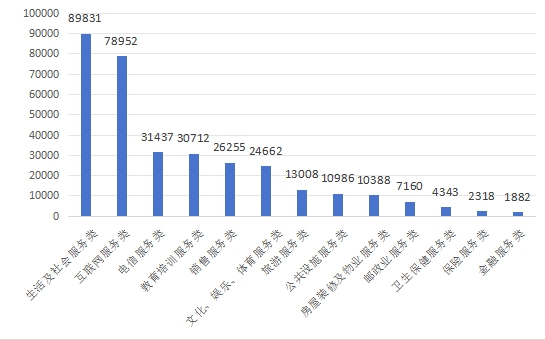

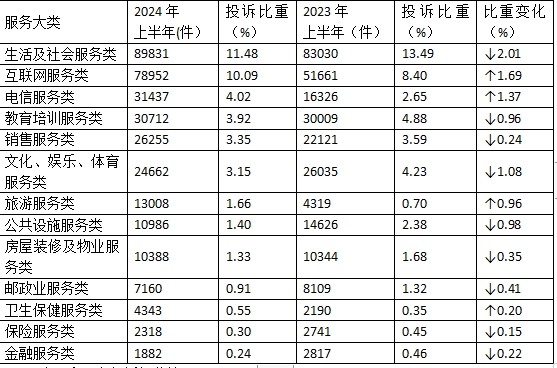

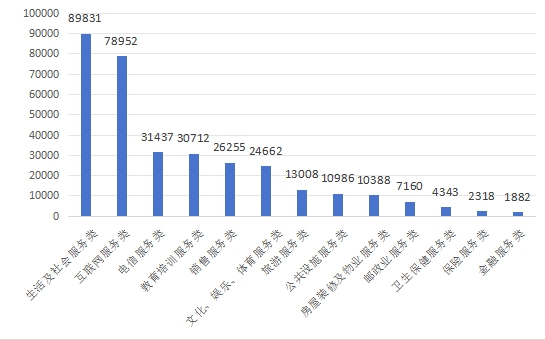

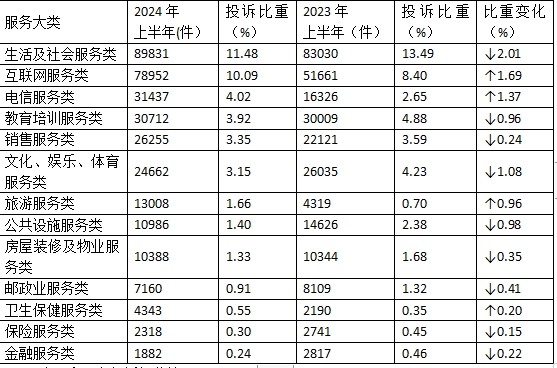

According to the complaint data of service categories in the first half of 2024 (as shown in Figure 3 and Table 3), life and social services, Internet services, telecommunications services, education and training services and sales services are in the top five. Compared with the first half of 2023, the proportion of complaints about Internet services, telecommunications services and tourism services increased, while the proportion of complaints about life and social services, cultural, entertainment and sports services and public facilities services decreased.

Figure 3 Complaint Volume Chart of Service Category (Unit: Pieces)

Table 3 Table 3 Changes of Service Complaints

(3) The breakdown of complaints about goods and services

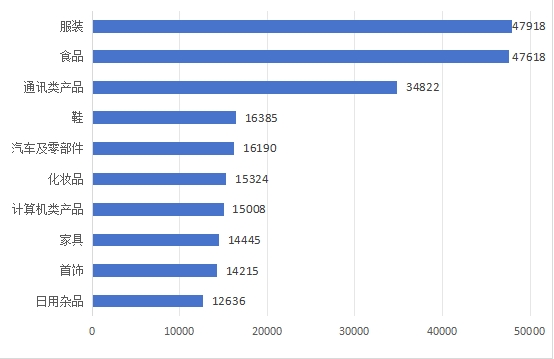

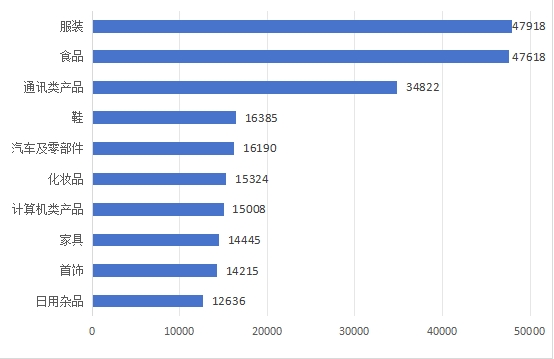

Among specific commodity complaints, the top five complaints are (as shown in Figure 4): clothing, food, communication products, shoes, automobiles and parts. Compared with the first half of 2023, the number of complaints about communication products, clothing and jewelry increased, while the number of complaints about automobiles, parts and daily necessities decreased.

Figure 4 Top Ten Complaints in Commodity Segmentation (Unit: Pieces)

Table 4: Top Ten Commodities with Complaints (Unit: Pieces)

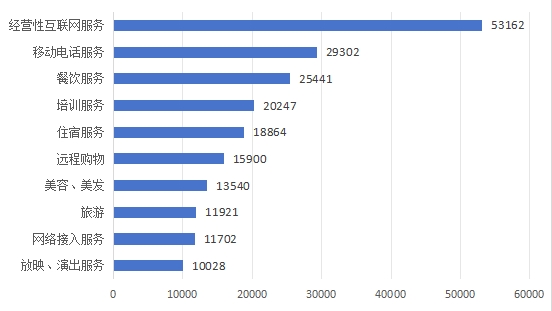

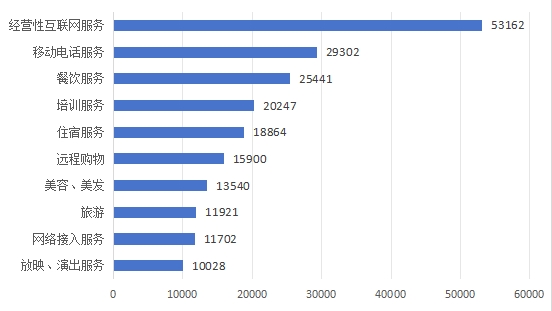

Among the specific service complaints, the top five complaints are (as shown in Figure 5) business Internet service, mobile phone service, catering service, training service and accommodation service. Compared with the first half of 2023, the number of complaints about tourism and mobile phone services increased significantly, while the number of complaints about beauty and hairdressing services decreased.

Figure 5 Top Ten Complaints in Service Subdivision (Unit: Pieces)

Table 5: Top Ten Services with Complaints (Unit: Pieces)

Second, the complaint hot spot analysis and typical cases

(1) The number of complaints about mobile phones increased significantly. Mobile phone is an indispensable tool in people’s daily life. In the first half of the year, the number of complaints about mobile phones was 23,671, a year-on-year increase of 65.54%, among which problems such as quality, after-sales service and false propaganda were more prominent. First, there are many disputes over after-sales service of folding screen mobile phones. During the warranty period of the folding screen mobile phone, there are problems such as liquid leakage and flower screen on the inner screen, but the merchants do not guarantee the mobile phone on the grounds of artificial damage, paint loss and wear, which leads to disputes. Second, online shopping merchants use refurbished machines to pretend to be new mobile phones for sale. After consumers find out, the platform or merchants only support returns and refunds, and do not assume the responsibility of "returning one and losing three". Third, there are a large number of complaints about the quality of mobile phones. The problems reflected by consumer complaints mainly include battery bulging, serious fever, stuck mobile phone, frequent restart and motherboard damage.

Case 1. On June 28th, 2024, a consumer, Mr. Liu, complained about a mobile phone brand through the platform of Consumers Association 315. On August 15th, 2023, he bought the first installment of the "Moon Shadow Black" folding screen mobile phone in the brand’s self-operated mall. In May, 2024, when the inner screen of the mobile phone was unfolded, it was found that it could not be displayed normally, and it was suspected that the inner screen was broken along the rotating shaft. On June 9, I went to the brand maintenance center for repair, and the staff refused to guarantee the mobile phone still under warranty on the grounds that "the painted area exceeded 0.3mm2". Consumers think that slight paint loss is the trace of normal use of mobile phones, and refusing the warranty on this ground is completely unilaterally stipulated by the manufacturer, which is equivalent to actually shortening the warranty period to several months, which is unacceptable under the overlord clause.

Case 2. On June 18th, 2024, the consumer Mr. Lu complained through the 315 platform of the Consumers Association. On June 15th, 2024, he spent 7340 yuan to buy Apple’s 14pormax mobile phone in a third-party shop of a shopping platform. When Mr. Lu consulted before purchasing, the merchant said that the mobile phone was brand new and unopened, and promised "one fake and ten penalties". On June 17th, after receiving the courier, the consumer found that the package was back-sealed, the seal glue of the packaging box had traces of secondary packaging, and there were use stains in the packaging box. In Apple official website, it was found that the mobile phone was activated in October 2022, and there was a usage record on June 15, 2024 in the mobile phone. The professional testing assistant showed that the battery had been replaced. Contact the merchant, and the merchant denies that it is a refurbished machine. Consumers believe that the business is fraudulent, and the complaint requires "one refund and three compensation" according to Article 55 of the Consumer Protection Law.

[Consumer Association’s Opinion] The Provisions on the Responsibility for the Repair, Replacement and Return of Mobile Phone Goods clearly stipulates that the three guarantees of the mobile phone host are valid for one year. However, if sellers and producers make three guarantees that are more conducive to safeguarding the legitimate rights and interests of consumers and are stricter than these provisions, they should fulfill them according to law. Within the validity period of the three guarantees, if there is a quality problem with the mobile phone host, the repairer will repair it free of charge. According to the above regulations, if the mobile phone host has related problems within one year or within the three-guarantee period promised by the operator, it should be repaired for consumers free of charge. If the operator thinks that the mobile phone does not meet the conditions for free maintenance, it shall bear the burden of proof. According to the relevant provisions of Article 26 of the Law on the Protection of Consumer Rights and Interests, operators have made unfair and unreasonable provisions to consumers, such as "no warranty for the appearance of mobile phones during the three-guarantee period", such as excluding or restricting consumers’ rights, reducing or exempting operators’ responsibilities and aggravating consumers’ responsibilities, and the relevant provisions should be invalid.

(2) The irregular operation of telecommunications services has been repeatedly prohibited. In the first half of the year, the number of complaints about telecommunications services was 31,437, a year-on-year increase of 92.56%. Non-standard business practices in the telecommunications industry are still repeatedly banned, and related consumption pain points and difficult problems have not been eradicated, and various problems still occur frequently. First, broadband services are easy to open but difficult to cancel. For example, when broadband is installed, it is not informed of the termination restrictions, but a high penalty is charged when it is cancelled, and some even unilaterally extend the contract term after the contract expires, making it more difficult for consumers to cancel. Second, the package upgrade is easy to downgrade. Consumers can change more expensive packages through APP, phone calls, text messages, etc., but when reducing packages, they need to contact and wait for the Commissioner to handle them. Some consumers even encounter online customer service and offline business halls to kick the ball in turn. Third, the problem of unfair marketing is prominent. Under the guise of free trial, free upgrade and free gift, operators’ salesmen deliberately hide or obscure key information such as minimum consumption, contract term, automatic renewal fee and liquidated damages to induce consumers to open paid services. Fourth, the professional ability of customer service needs to be improved. Some customer service staff have concealed, perfunctory behaviors and even contradictory explanations when answering consumer inquiries or handling related businesses.

Case 1. On June 26th, 2024, a consumer, Ms. Zhu, complained to a communication company through the platform of Consumers Association 315. She contacted the customer service of the company in early June, 2024, and requested to apply for 8 yuan package online. The consumer’s number was not bound by any other unexpired package. The company’s customer service made various excuses, saying that it had no authority and asked the Commissioner to handle it for consumers. The Commissioner also said that consumers should go to the offline business hall to handle it, but consumers didn’t have time to go offline specifically. As of the time of complaint, the consumer has communicated with the customer service for no less than 10 times, and it has not been successfully handled. Consumers question why the upgrade package can be processed online at the beginning, and the reduction package has to go offline. They think this is an unfair and unreasonable requirement, which restricts consumers’ freedom to handle business in disguise and deliberately sets unreasonable thresholds.

Case 2. On June 23, 2024, Mr. Lan complained to a communication company through the platform of Consumers Association 315, saying that he contacted the customer service of the communication company on March 22, 2024, and because he no longer used the company’s broadband service for the reason of moving, the customer service replied to the broadband service on the APP by clicking unsubscribe and disassembling. The consumer then unsubscribed and disassembled the machine according to the operation, but there was no SMS notification or customer service phone reply. It was not until June 20 that the bill was checked that the unsubscribe was not processed at all, and the fee was still deducted every month. After receiving the complaint, the communication company contacted the consumer to make a settlement, and returned the function fee 160 yuan generated during the non-cancellation period (March to June) to the consumer.

[Opinions of Consumers Association] Telecommunication service is closely related to consumers’ daily life, and it is one of the important services for people’s livelihood. Relevant operators should strengthen their sense of social responsibility, improve their customer service ability and quality, standardize their own business behavior, and pay enough attention to the problems reflected by consumers and give timely feedback. In 2022, the Ministry of Industry and Information Technology issued the Notice on Further Regulating Telecommunications Services, which called for optimizing publicity and display, facilitating business change and cancellation, standardizing telephone and SMS marketing, and improving port number transfer services. It is suggested that the relevant authorities should strengthen the supervision and governance of all kinds of violations of consumers’ rights and interests in the telecommunications industry and implement the provisions of relevant documents.

(3) The marketing of member services needs to be standardized. Member service is an important means for operators in various industries to attract and retain consumers, but the irregular behavior in the operation process has caused many consumer complaints. First, modify the membership system and rules at will. Operators frequently adjust the service content of members, and adjust the rights and interests of old members on the grounds of "expiration of welfare period". If old members want to use the original functions, they need to upgrade and buy more expensive members. Second, the membership rules are complicated. Operators set up multiple and complicated membership systems such as membership, svip, AI membership and big membership, and set up various packages under different members, so it is difficult for consumers to find out the differences in service contents among different members. Third, automatic renewal is enabled by default and it is difficult to cancel. Some member service providers set automatic renewal as the default option without the consent of consumers, which leads to many steps to turn off automatic renewal and difficult to hide the page. The fourth is the issue of false propaganda. Such as exaggerating the content of membership services and concealing the conditions for restricting the use. Fifth, the risk of third-party membership service is high. Some consumers buy member services at low prices through third-party platforms, but the service period is forced to be terminated early by the member service provider because the third-party merchants "run away".

Case 1. On June 20th, 2024, Mr. Zhang complained about an office software company through the platform of Consumers Association 315. Mr. Zhang said that the members of the company were previously divided into ordinary members, rice husk members and svip, and consumers bought svip. Around October last year, consumers found that ordinary members and rice husk members were gone, ordinary members were upgraded to svip, and svip could be upgraded to svip pro, but it needed to be converted according to the new price. After the conversion, consumers’ membership time was reduced by one month. On the day of the complaint, the consumer found that svip pro was cancelled again, and became a member of svip and AI and a big member. If they want to use related functions, they have to upgrade to a big member.

Case 2. On May 25th, 2024, Mr. Hu complained about a video member company through the platform of Consumers Association 315. On March 15th this year, Mr. Hu bought a one-year membership service of a video member company on a shopping platform, the amount was 138 yuan, and the expiration date of the membership should be March 14th, 2025. However, more than a month after purchase, consumers found that the purchased membership service was unusable, and after repeated login and refresh, they all prompted the members to expire. The consumer contacted the seller of the e-commerce platform and found that the seller had run away. Consumers complained to the platform, and the platform replied "urging the seller" or "waiting patiently", and the problem has not been solved.

Case 3. On March 18th, 2024, Mr. Ji complained about a company through the platform of Consumers Association 315. On October 23, 2023, he met a salesperson of a company to promote VIP membership cards at the Three Gorges Airport in Yichang, Hubei. The company’s sales staff told consumers that they are a professional ticketing company that cooperates with airlines. The price is cheaper than a booking platform commonly used by consumers, and some VIP lounges at the airport are also provided free of charge. But you need to deposit 1698 yuan in advance, and you can deduct it from the deposit in the future. The consumer then paid 1698 yuan to buy a membership card. Since then, consumers have booked seven flights on the company’s platform and found that it is seriously inconsistent with the propaganda of the sales staff at that time. The first is the price. The ticket price of the same flight on this platform is more expensive than other platforms. Secondly, the pre-stored expense deduction only deducts 20 yuan at a time, which is completely different from the full deduction of consumption expectation, and the salesman deliberately hides these key information when selling. Mr. Ji complained that he wanted to return the remaining unused 1468 yuan.

[Opinions of Consumers Association] Doing a good job in protecting consumers’ rights and interests is the key to the sustained and healthy development of member economy. A complex and changing member system may bring certain profits to enterprises in a short time, but in the long run, it will damage the reputation of enterprises and consumer trust. While pursuing profits, member service providers should respect and protect consumers’ right to know and choose independently, provide clear, transparent and concise member service systems and rules, and truly take consumers as the center. Consumers should pay attention to whether the option of automatic renewal is checked by default when purchasing membership services. After purchase, you can check the automatic renewal status in your account and cancel the unnecessary automatic renewal option in time.

(D) Shared services should focus on enhancing the consumer experience. Bike-sharing, shared charging treasure and other shared products improve the convenience of consumers’ daily life, but there are also some problems in the use process, which affect consumers’ experience. First, the shared products are not returned smoothly. Due to inaccurate display of business information and untimely status update, it is difficult for consumers to find the correct return place after using bike-sharing and shared charging treasure, and they are forced to extend the charging time. Second, the failure of bike-sharing affects the safety of use. Consumers reported that when using the bike-sharing, they encountered brake failure, improper handlebars, damaged pedals and other phenomena, and there were potential safety hazards. Third, there are frequent disputes over deduction. Consumers mainly report that they have been charged for not using the shared products (such as not unlocking successfully after using bike-sharing code scanning and not popping up after using shared charging treasure code scanning), or have not stopped charging after returning the shared products.

Case 1. On March 17th, 2024, Ms. Lin complained through the platform of Consumers Association 315. At 3: 21 pm on March 9, 2024, she borrowed a charging treasure from a Beijing West Road store in an express hotel, and returned it at about 4 pm. Since she never received the deduction information after returning it, she called the hotel customer service on the same day to feedback this question. The hotel customer service asked the consumer to go to the charging treasure customer service for feedback, but the consumer did not find the order on the major charging treasure applets. So the consumer called the hotel again, and the hotel customer service said that it would feedback this question. It was not until the day of the complaint that the consumer received the charging treasure deduction information, and the consumer was deducted for two days. The consumer called the customer service again, and the customer service feedback waited patiently. The consumer then applied for a refund on WeChat but was rejected by the hotel. After contact with Huaqiao Economic Development Zone Branch of Kunshan Consumer Rights Protection Committee, Jiangsu Province, the merchant has refunded the fee to the consumer.

Case 2. Consumer Mr. Su complained through the 315 platform of the Consumers Association that he recently unlocked a bicycle of a bike-sharing enterprise by scanning the code in Jinan, Shandong Province, and immediately found that the bicycle chain was damaged and could not be ridden, and then immediately locked the bicycle. As a result, the consumer was prompted that the bicycle was not in the specified parking spot, and 5 yuan dispatching fee should be charged to the consumer. So the consumer contacted the company’s online customer service and suggested that the relevant fees should not be charged. Although the company’s online customer service recognized the consumer’s point of view, it said that it could only give a five-day cycling card. Unable to accept this solution, the consumer called the company’s telephone customer service three times, and the responses of the three customers were the same as those of the online customer service. One customer service directly hung up after the communication failed. Consumer complaints require the company to apologize and refund the dispatching fee.

[Opinions of Consumers Association] Operators related to shared products and services should strengthen the daily maintenance of shared products, and timely repair and replace products with quality problems and safety risks to reduce the occurrence of failures and maximize the personal safety of consumers; According to the consumer’s usage, the placement position and placement point are reasonably optimized to improve the consumer’s experience; Improve the communication channels of consumer complaints and establish a benign interaction mechanism to achieve a win-win situation for corporate profits and consumer convenience.

(E) Online shopping "short weight and short weight" occurs from time to time. The shortage of online shopping products may not only make consumers suffer economic losses, but also affect the image and reputation of related operators and platforms in the eyes of consumers. The main problems reflected by consumers are: First, the weight of goods is insufficient. Some merchants deliberately blur the net weight and gross weight when marking the weight of goods, or include packaging, accessories and fillers in the total amount. The actual weight of goods received by consumers is far lower than the advertised weight. Second, the quantity of quantitatively packaged goods does not match the actual quantity. There is a big gap between the actual number of quantitatively packaged goods sold by some merchants online and the number of packaging labels and the allowable shortage of regulations. Third, the size of online shopping TV has shrunk. Some operators who specialize in selling cottage brands and small-brand TVs through online channels have the problem of virtual standard screen size. After consumers find out, businesses not only do not bear the responsibility of false propaganda, but consumers also have to bear the freight when returning goods.

Case 1. Recently, Ms. Weng, a consumer, complained about a take-away platform through the Consumer Association’s 315 platform, reflecting that she bought a box of salted duck in a shop on the take-away platform. The product page described that the weight was 701g. After receiving the salted duck, the consumer weighed it unopened and found that the total weight was only 358g. The consumer communicated with the store through the take-away platform, and the seller said that the duck was reprocessed and made dry, and did not admit that it was short of two pounds. Later, the product details page was changed, and the description at the time of ordering was changed from 701g to 501g.

Case 2. Recently, Mr. Xu, a consumer, complained about an e-commerce platform through the Consumer Association 315 platform, where he bought garbage bags. The merchants advertised the goods on the product page in five volumes, with 20 pieces in each volume, totaling 100 pieces. Results After receiving it, consumers found that there were only 12 in each roll, and only 60 in five rolls, which was quite different from the description, lacking 40%. Consumer complaints require businesses to "refund one and compensate three" according to the provisions of the Consumer Protection Law on punitive damages, and less than 500 yuan is calculated as 500 yuan.

Case 3. On March 27th, 2024, the consumer Mr. Li complained about an e-commerce platform through the Consumer Association 315 platform. On March 4th, 2024, he bought a brand of 55-inch LCD TV in a third-party store of the e-commerce platform. After receiving the goods, the ruler was only 48 inches, and the manufacturer’s name in the 3C certification provided by the merchant’s customer service was not the same as that in the certificate in the TV packaging box. The consumer consulted the brand manufacturer, and the manufacturer said that the company only produced computer tablets, never produced televisions, and did not authorize others to use its trademarks. Consumers found on the referee document network that the manufacturer had trademark infringement lawsuits with a number of well-known TV brands in the 3C certification provided by the merchant customer service, and was fined heavily for losing the case. Consumers said that the TV set was still sold on the e-commerce platform when they complained, and that the e-commerce platform failed to review the counterfeit trademarks and false propaganda behaviors of merchants, and did not take necessary measures to require the e-commerce platform to bear the responsibility of "returning one and losing three".

[Opinions of Consumers Association] Recently, the General Administration of Market Supervision issued the Notice on Further Deepening the Comprehensive Improvement of the Market Order of Electronic Pricing Scales, focusing on outstanding issues such as "short weight and short weight" and carrying out comprehensive improvement of the market order of electronic pricing scales nationwide. Through rectification, the number of complaints related to "short weight and short weight" in the offline market has declined, but related problems in the field of online shopping still occur from time to time. The two problems of short weight and short weight of online shopping products have strong concealment. If consumers do not have certain life experience or do not weigh, check and verify after receiving goods, it is difficult to find related problems. It is suggested that the relevant regulatory authorities increase the spot check and supervision of the problem of "short weight and short weight" in online sales of goods. Remind consumers to choose regular businesses with good reputation as far as possible, and avoid coveting cheap goods that are obviously lower than the market price. Operators should carefully verify the actual size or weight of the goods sold, accurately mark them, and prevent misleading consumers.

(VI) The protection of financial consumers needs to be strengthened. Financial services in modern society have profoundly affected all aspects of people’s lives, and consumers’ food, clothing, housing, transportation, daily necessities are inseparable from the support of financial services. In the first half of the year, consumer complaints about financial services mainly included: First, the loan collection behavior was not standardized. Some online lending companies illegally collect information such as mobile phone address book when consumers borrow money. After the borrower is overdue, online lending companies will "bomb" relatives, friends, colleagues and other contacts in their address book by SMS or telephone. Second, online lending companies charge usury in disguise. Some online lending companies use low interest rates as bait to induce consumers to borrow money. After borrowing, consumers find that there are various fees such as intermediary fees, guarantee fees, membership fees and equity fees, and the actual interest rate is much higher than the statutory maximum interest rate. Third, false marketing of insurance has been repeatedly prohibited. The performance is that the sales staff of insurance companies exaggerate the scope of protection and conceal the refusal to pay compensation.

Case 1. Recently, Mr. Li complained about a financial company through the platform of Consumers Association 315. He received a sales call from the company on May 19th, and the salesman said that he could borrow money from him to ease the economic pressure. With Mr. after li, he logged into the company’s APP to apply for a loan of 10,000 yuan. When borrowing, the bill showed that he would pay back 1,008.99 yuan every month and repay it in 12 months. Mr. after li found that the down payment became 1,756.99 yuan. Mr. Li contacted the customer service of the company. The customer service said that there were membership rights fees in the first three periods, and the rights fees in each period were more than 700 yuan, with the first repayment of 1756.99 yuan, the second repayment of 1744.99 yuan and the third repayment of 1732.91 yuan. Mr. Li said that he didn’t sign any rights and interests at that time, and he didn’t open a membership. If he had known there was such an invisible fee, he wouldn’t have used it. Moreover, the bill at that time was only 1008.99 yuan, and the so-called membership rights and interests fee of more than 700 yuan was not shown. Mr. Li complained that he wanted to cancel the membership fee.

Case 2. On June 23, 2024, Mr. Zhu complained to an insurance company through the platform of Consumers Association 315. In March 2018, Mr. Zhu saw the insurance company promoting the "Good Medical Insurance" project, claiming that it was free of compensation. The sales staff specially emphasized that all unexpected medical expenses could be paid. At that time, consumers felt that they could buy it in an emergency. On June 7, 2024, Mr. Zhu suffered a comminuted fracture of his palm due to an accidental fall. He was hospitalized for emergency surgery and chose the nearest hospital for treatment. In the follow-up claim, the insurance company said that the hospital where Mr. Zhu went to see a doctor was not a company-approved hospital. Mr. Zhu said that at that time, the insurance company publicized that it was free of compensation, and did not remind which hospitals could not settle claims. Consumer complaints require insurance companies to pay for medical treatment, lost work and follow-up maintenance costs.

[Opinions of Consumers Association] The Third Plenary Session of the 20th Central Committee decided to improve the mechanism of protecting financial consumers and cracking down on illegal financial activities. In recent years, financial supervision departments have intensified their efforts to deal with such problems as violent collection, usury and false insurance propaganda, but related problems have still not been eliminated. It is suggested that financial supervision departments and financial institutions should control the problems of violent collection and usury from the source, appropriately increase the supply of resources of financial institutions such as banks by opening the front door and blocking the back door, improve the quality of financial services, and allow more consumers in need to obtain financial loans and other services through formal channels.

(7) The popularity of complaints related to concerts has not diminished. Since last year, the performance market has continued to be hot, and the number of complaints in related fields has been at a high level. First, the ticketing platform and the rights and obligations of consumers are not equal. For example, the ticketing platform stipulates that consumers need to bear the fare loss for their own reasons; However, if the performance is postponed or cancelled due to the organizers and actors, the ticketing platform can unilaterally terminate the contract and keep silent about the liability for breach of contract. Second, the ticketing platform sells tickets for performances, but it is not responsible for the obstruction of vision. The ticketing platform did not clearly indicate that the corresponding seats were blocked when selling tickets. Consumers later reported to the ticketing platform that they wanted to refund part of the fees, but the ticketing platform refused to bear the corresponding responsibilities. Third, the consumers’ right to know is not guaranteed. Consumers can’t know the specific seats when purchasing tickets, and some consumers report that the seats purchased first at the same price are worse than those purchased later. Fourth, the ticketing platform can change the seat fare at will. Consumers choose high-priced seats when purchasing tickets, but after issuing tickets, they find that they are arranged in low-priced areas. After consumers raised questions, the platform changed the low-end price area to high-end price. Fifth, disputes over refund are frequent. Consumers report that the refund fee charged by the platform is too high, and the refund rules of different performances of the same organizer are inconsistent.

Case 1. On April 29th, 2024, a consumer, Mr. Liu, complained about a ticketing platform through the 315 platform of Consumers Association. On January 29th, he bought two vip tickets for a star’s Tianjin concert on the ticketing platform, and the seats were No.1 and No.2, Row 6, vip2 District. Arriving at the scene, I found that there were three staff members standing in the chair in front of this seat, taking photos and videos, which seriously blocked the performance. Mr. Liu gave feedback to the staff on the spot, and the staff said that this position is a fixed position and needs video recording, which cannot be avoided. Consumers pointed out that this position is the most expensive ticket price in the audience. If this position must be videotaped, it should not be sold, or the "bad sight area" should be marked before the sale, but there is no hint. Afterwards, consumers complained to the ticketing platform four or five times, all of which indicated that they could not solve it. Consumer complaints demand compensation from the ticketing platform.

Case 2. On June 28th, 2024, the consumer Mr. Lu complained about a ticketing platform through the 315 platform of the Consumers Association. On June 18th, he bought two Nanjing concerts of a celebrity on a ticketing platform, and the seat area he chose for the purchase was 580 yuan stall. The consumer bought two tickets, totaling 160 yuan. As a result, when the ticket was issued, Mr. Lu found that the price of the seat area on the ticket was actually 380 yuan. Mr. Lu contacted the customer service of the ticketing platform to solve this problem. As a result, after consumers waited for a period of time, the final solution given by the ticketing platform turned out to be to change the original 380 yuan seating area into a 580 yuan stall.

[Consumer Association’s opinion] The ticketing platform should make a clear seat map of the venue, and mark the seats with blocked vision to protect consumers’ right to know and choose. If the ticketing platform can’t provide the venue seat map and mark the blocked seats, consumers who have purchased the blocked seats should be compensated accordingly. The provision that the performance ticketing platform is not responsible for the delay or cancellation of the project, but the consumers should bear the liability for breach of contract for returning tickets and exchanging tickets for their own reasons not only does not conform to the basic principles of fairness and reasonableness in civil contracts, but also does not conform to the principle of preferential protection for consumers in consumer contracts. It is suggested that the ticketing platform should refer to relevant foreign practices and open online ticket transfer channels on the ticketing platform. For consumers who are unable to attend the event for personal reasons, tickets can be transferred to other consumers in real-name registration system in a digital way with the original ticket price not higher than the original ticket price through the platform, so as to reduce disputes arising from refund.

(8) The dispute over the refund of fees for teaching and training services continues. Complaints about teaching and training services have not diminished, among which contract problems and false propaganda account for a relatively high proportion. First, training institutions do not refund fees as promised. Some training institutions related to further education, employment and qualification examinations claim that they can get a full refund if they fail the examination. However, when consumers who fail the examination ask for a refund, the training institutions have delayed the refund for various reasons. The second is the false promise of training institutions. For example, training institutions publicly claim that they can pass exams, get certificates, take part-time jobs, make money, etc., and some even claim that they can obtain various certificates by paying money without attending classes. Third, the training institutions are mixed. The actual teaching level and publicity of some training institutions are very different. Some institutions’ teaching courses are all recorded and broadcast videos, and some even have no qualifications for running schools. Fourth, training institutions induce consumers to apply for "training loans", and subsequent institutions run away, and consumers have to bear loan debts.

Case 1. In April 2024, Ms. Pan, a consumer in Wuxi, Jiangsu Province, complained about an educational institution in Shijiazhuang, Hebei Province through the 315 platform of the Consumers Association. In March 2022, Ms. Pan paid 15,300 yuan for training in this institution, and the institution promised to ensure that Ms. Pan got the undergraduate diploma and degree certificate of a university within two years. However, two years later, Ms. Pan only got a diploma and no degree certificate. The agency explained that it was due to force majeure such as "epidemic situation" and national policy regulation, so it was impossible to obtain a degree certificate. Ms. Pan was very angry and said that she already had a bachelor’s degree certificate. The reason why she chose this educational institution was that she claimed that she could get a degree certificate. It took two years and cost 15,300 yuan, but she didn’t get what she really wanted. She asked for a refund of all the fees and demanded mental compensation. After several rounds of mediation by Shijiazhuang Consumer Protection Committee, the operator finally refunded all tuition fees and miscellaneous fees of 13,300 yuan to consumers.

Case 2. Recently, Ms. Li, a consumer in Guiyang, Guizhou, complained about a training institution in Hubei through the 315 platform of Consumers Association. The so-called "enrollment teacher" of the institution called Ms. Li to introduce the education upgrading training, and induced Ms. Li to sign up impulsively by including intensive training before the exam. Because the tuition fee is 6980 yuan, which Ms. Li can’t afford, the institution induces Ms. Li to apply for a teaching loan. After paying the money, Ms. Li found that such a high tuition fee turned out to be just a "class teacher" WeChat and a recording and broadcasting software selling courseware. She felt that she was seriously deceived and asked the "enrollment teacher" to drop out of class. The other party has been persuading not to drop out of class. Seeing Ms. Li’s firm attitude, she said that she could not drop out and continued to fool Ms. Li into paying off the loan to freeze the class. Ms. Li complained that she wanted to terminate the loan and refund the fee.

[Opinions of Consumers Association] Article 20 of the Law on the Protection of Consumers’ Rights and Interests stipulates that the information provided by operators to consumers about the quality, performance, use and expiration date of goods or services shall be true and comprehensive, and no false or misleading propaganda shall be made. The operators of training institutions claim that the so-called "passing exams, obtaining certificates, taking part-time jobs and making money" is not only suspected of falsely propagating illegal activities, but may seriously constitute a crime. It is suggested that relevant departments strengthen law enforcement and investigate illegal activities of illegal training institutions. According to China’s Academic Degrees Law and educational policies related to academic degrees, the qualifications, conditions, procedures and management of degree awarding are clearly defined. Remind consumers that they should study hard to obtain corresponding degrees and certificates, and illegal purchase of academic degrees and certificates may be "both human and financial".

(9) Online game suspension caused many complaints. There are many incidents of online games stopping service, and the resulting consumer disputes have become a difficult problem that puzzles consumers. The main problems reflected by consumers are as follows: First, delete the consumer data account after stopping taking the service. Consumers spend a lot of money in online games to exchange game coins, game props, equipment, cards and other virtual properties, but all of them are deleted because online games stop serving, so consumers’ virtual properties are lost. Second, the compensation scheme for stopping taking medicine is unreasonable. After online games are stopped, game operators often give so-called compensation schemes unilaterally. Consumers can only recharge the unconsumed virtual currency and spend it at a discount in other games under the company, while virtual property has no compensation. Third, there are overlord clauses in online game agreements. If the agreement stipulates that the online game operator has the right to terminate the game service according to the actual situation, and does not have to bear the responsibility.

Case 1. On May 4th, 2024, a consumer, Ms. Xu, complained about an Internet company through the platform of Consumers Association 315. On April 17th, the operation team of the company suddenly announced that the game was stopped and all data was deleted. The announcement issued by it stipulates: "Once you participate in the compensation activities, it will be regarded as an approval of the compensation/replacement scheme. If the user does not participate in the compensation activities within the above-mentioned time limit, it will be regarded as an automatic waiver of the right to compensation/replacement. " There is no prior consultation on the way to change and compensate the service, and attempts to exclude consumers’ rights to claim damages through this standard clause. For the unused virtual currency, the compensation mentioned in the announcement is only the virtual currency gift packages of other games owned by the company, which are not returned in legal tender or other ways accepted by users in accordance with relevant regulations, and the above format terms are used to threaten and induce players to accept the compensation scheme formulated unilaterally to reduce their own responsibilities.

Case 2. On June 17, 2024, Ms. Mo complained to an Internet company through the platform of Consumers Association 315. She started to play the game operated by the company on December 4, 2022, and as of June 9, 2024, the total consumption in the game was 9924 yuan. Recently, the company’s official account suddenly announced the suspension of operation. The announcement indicated that the game would be closed on June 18th and the player’s account data and character data would be deleted. The announcement claimed that the paid tokens not consumed in the game could only be compensated by redeeming other game packages owned by the company, and said that if the user did not participate in the compensation within the time limit, it would be regarded as an automatic waiver of compensation/replacement rights. Consumers think that this compensation method has not been communicated with the players, and it has not been recognized by the players, and the players have no choice. This behavior is no different from buying and selling hard, which seriously infringes on the rights and interests of players. Consumers complained for monetary compensation.

[Opinions of Consumers Association] Article 26 of the Law on the Protection of Consumer Rights and Interests stipulates that business operators shall not make unfair and unreasonable provisions to consumers, such as excluding or restricting consumers’ rights, reducing or exempting business operators’ responsibilities, and aggravating consumers’ responsibilities, in the form of standard clauses. Some online game operators take advantage of market dominance or dominant position to give themselves the right to terminate their game services at will without taking responsibility through game agreements, reduce their own responsibilities and increase consumers’ responsibilities, which violates consumer fairness. Such "overlord clauses" should be invalid. Online game operators unilaterally stop service, in addition to issuing a notice of stopping service according to law, they should also bear the corresponding liability for breach of contract and take reasonable, necessary and timely measures to protect the legitimate rights and interests of consumers. Virtual currency, such as game currency, which consumers recharge, belongs to consumers’ prepaid expenses in essence. For the game service that is still within the performance period, it should be compensated or compensated in legal tender or other ways acceptable to consumers based on factors such as duration, items and amount.