The default situation of credit bonds continues unabated. According to Wind statistics, as of June 30, the default scale of credit bonds this year has reached 98.573 billion yuan, far exceeding the level of the same period last year. Among them, the overdue principal of bonds is 91.338 billion yuan and the overdue interest is 7.235 billion yuan.

Insiders interviewed by reporters said that the deterioration of default data in the first half of this year was mainly due to the risk exposure of several major entities such as HNA Group and Huaxia Happiness, which can be said to be the result of the accumulation of default risks in the previous period. Looking forward to the second half of the year, the default situation may continue, and the credit differentiation will further intensify.

At the same time, with the gradual normalization of bond market default, the redemption rate of bonds after default has also decreased year by year. Although private enterprises are still the main force of default, the scale of default of state-owned enterprises has increased rapidly. According to statistics, in the first half of 2021, the balance of default bonds of local state-owned enterprises totaled 36.411 billion yuan, accounting for 79% of the default amount of local state-owned enterprises’ bonds last year, which continued to impact the "belief in state-owned enterprises". Some analysts said that there have been two major trends in the default of credit bonds. First, state-owned enterprises with weak qualifications will become a breakthrough to break the just exchange; Second, the tail real estate company will accelerate the market clearing.

The scale of credit debt default has expanded.

Since the beginning of the year, credit bond defaults have occurred frequently. According to statistics, there were 13 new issuers who defaulted for the first time in the first half of the year, including 7 issuers in the first quarter and 6 issuers in the second quarter. However, this figure is down from 19 in the first half of 2020.

According to the analysis of CICC’s collection team, in contrast, the cumulative number of issuers who defaulted in the first half of this year and in the two quarters showed a downward trend year-on-year. The decrease in the number of issuers who defaulted was related to the greater efforts of supervision and local governments to maintain stability, and repeatedly stated that they had zero tolerance for malicious "evasion of debts", actively guaranteed bond payment and restored market confidence.

Although the number of new defaulting subjects has decreased, the scale of default has not decreased. According to the reporter’s statistics, as of June 30th, the number of defaults on credit bonds reached 120 this year, with a scale of 98.573 billion yuan, compared with 94 and 72.995 billion yuan in the same period last year. Among them, the overdue principal of bonds this year is 91.338 billion yuan, and the overdue interest is 7.235 billion yuan.

"This is mainly due to the risk exposure of several major defaulting entities, such as HNA Group and Huaxia Happiness, which is the result of the accumulation of risks in the early stage." A director of fixed income of a fund company told reporters. For example, in the first half of the year, a number of issuers of Hainan Airlines were ruled by the court to accept bankruptcy and reorganization applications, and all the surviving bonds were deemed to be due to breach of contract, which in turn pushed up the number and amount of defaulted bonds in the first half of the year.

Ming Ming, deputy director of CITIC Securities Research Institute, also told CBN: "The scale of default under the conventional caliber includes the subjects that have defaulted over the years. If their surviving bonds expire in the first half of 2021, they will also be included in this year’s default, resulting in large data. In particular, the defaults in the first half of this year included large bond entities such as Kangmei, Huaxia Happiness, Huaxin and Taihe, which led to a higher amount than the same period last year. "

Mingming also said that considering the risk of default in the first half of this year, it is usually compared with the first default of enterprises. In the first half of this year, the new default was 8.65 billion yuan, which was lower than 13.38 billion yuan in the same period last year.

Real estate default accounts for a large proportion

From the perspective of industry distribution, in the first half of this year, bond defaults were mainly concentrated in comprehensive, real estate, air transport, construction and engineering industries. Among them, the default scale of the real estate industry was 19.192 billion yuan, ranking first. Some insiders predict that the market-oriented clearing will be accelerated in the future under the background that the real estate regulation is not relaxed.

CICC’s collection team believes that this is because real estate development enterprises have the problems of large cash inflow and outflow, frequent policy regulation and tight refinancing as a whole, and naturally have the characteristics of high credit risk.

In fact, since 2018, with the marginal tightening of real estate financing and the arrival of the peak of real estate corporate bonds maturity, the default of real estate bonds has gradually been exposed. Especially since May last year, local regulatory policies have been tightened again, and the continuous financing shortage has stretched the capital chain of some real estate industries.

After the default of three real estate enterprises in the first half of this year, the institutions intensified their risk investigation on the real estate sector, and their attitudes tended to be cautious. "Some small and medium-sized housing enterprises have relatively high debt ratios, and the financing channels faced by the industry have narrowed, so they are prone to default." Macro analyst Zhou Maohua told reporters.

It is also worth mentioning that on July 12, Sichuan 100 billion-level housing enterprise Blu-ray Development Co., Ltd. also defaulted. The announcement shows that as of the end of the due date, the issuer failed to raise the full repayment funds as agreed, and "19 Blu-ray MTN001" failed to repay the principal and interest in full on schedule, which constituted a material breach of contract.

It is reported that the issuance scale of "19 Blu-ray MTN001" is 900 million yuan, with a term of 2 years. The interest rate of the bonds in this interest period is 7.5%, and the amount of principal and interest payable is 967.5 million yuan. The redemption date is July 11, 2021 (the actual redemption date is July 12, 2021).

Looking forward to the future credit bond market, many people in the industry expressed optimism. The aforementioned fixed income director of the fund company told reporters that it is expected that the credit default situation will continue in the second half of the year. After all, the credit financing environment has not been relaxed, and the policy has been tightening the review of urban investment bonds and real estate bonds. The performance of the credit market will be more differentiated, and the sinking of qualifications will be more cautious.

Zhou Maohua said that from the trend, domestic defaults will not rise sharply, mainly because the overall domestic monetary and credit environment remains reasonable and moderate, and accurately supports short-term weaknesses. At the same time, the economy and domestic demand are recovering steadily, the overall profit of enterprises tends to improve, and the market financing function is sound.

"We should treat the domestic bond market default rationally. A certain amount of bond default will help to find the market price, force enterprises to operate steadily, reasonably debt, and continuously improve operating efficiency; It also helps the market mechanism to play its role and promote the efficiency of market resource allocation. " Zhou Maohua also mentioned.

Decreasing the redemption rate of default bonds

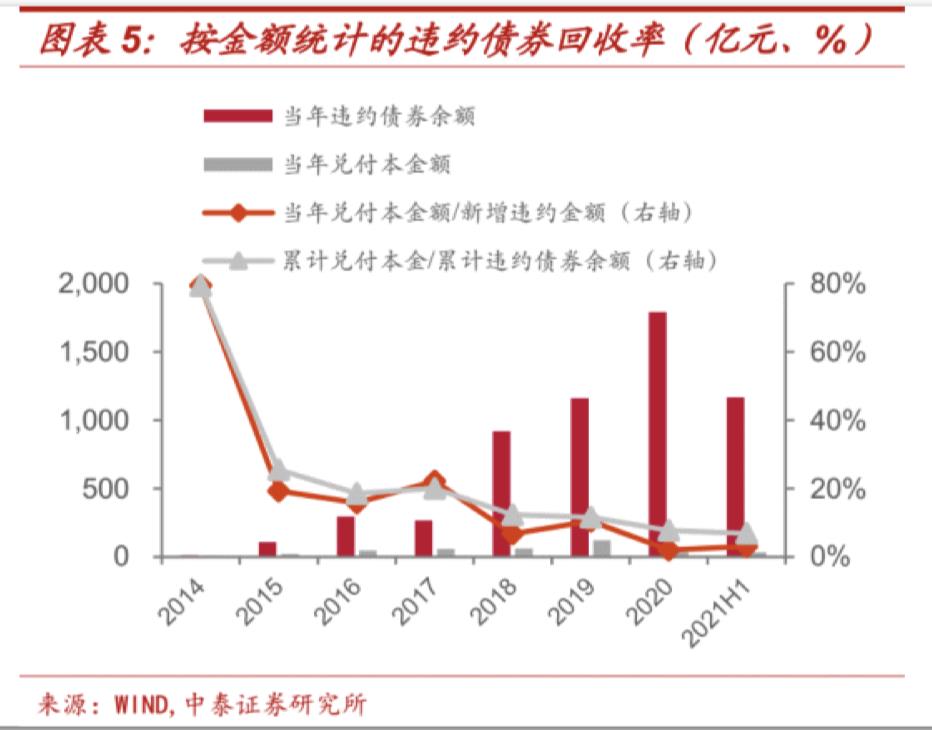

As the default of credit bonds tends to be normalized, there is also a phenomenon that the payment ratio of default bonds is also decreasing.

According to the statistics of Zhongtai Securities, the proportion of the accumulated principal paid by default bonds to the accumulated balance of default bonds has dropped from 79.37% at the end of 2014 to 6.87% at the end of the first half of 2021; The proportion of fully paid bonds to default bonds decreased from 20% to 7.16%. This means that once the bond defaults, investors will face greater losses.

Generally speaking, after the bond defaults, enterprises mainly have five ways to deal with the default, namely litigation arbitration, bankruptcy litigation, self-financing repayment, debt restructuring and collateral disposal/guarantor compensation. In general, self-raised funds, debt restructuring and bankruptcy litigation are three common disposal methods, among which debt restructuring and self-raised funds have shorter redemption period and higher recovery rate than bankruptcy restructuring.

In addition, there are differences in default payment of different types of bonds. For example, from the perspective of the nature of enterprises, Zhongtai Securities analyzed that by the end of June 2021, 40 of the 135 private enterprises that had defaulted on bonds had partially or fully paid the defaulted bonds, with a redemption probability of 29.63%; However, local state-owned enterprises and central state-owned enterprises have higher redemption probabilities, which are 38.46% and 36.36% respectively.

However, in recent years, with the substantial increase in the default scale of local state-owned enterprises and the successive default of bonds issued by some central enterprise groups, "the redemption ratio of local state-owned enterprises and central enterprises according to the amount of redemption and the number of fully redeemed bonds has been lower than that of private enterprises." Zhou Yue, chief analyst of Zhongtai Securities Solid Revenue, said.

Specifically, in the first half of 2021, the cumulative redemption amount of local state-owned enterprises accounted for 5.03% of the bond default scale, compared with 13.95% at the end of 2018; The proportion of central enterprises is 4.20%, and it was 17.26% at the end of 2018. Zhou Yue further believes that at present, there are two tendentious problems in the default of credit bonds. First, weak state-owned enterprises will become a breakthrough to break the just-redeemed; Second, the tail real estate company will accelerate the market clearing.