Affected by the state’s measures to boost consumption, on the 19th, the big consumption sector "rose by the wind", with household appliances, leisure services, food and beverage sectors among the top gainers. The agency believes that the pace of consumption recovery is expected to accelerate as the policy continues to be effective and the market continues to repair. Among them, the optional consumption sector maintained a good momentum of prosperity in the fourth quarter with a high probability, and the annual performance was highly certain.

The big consumption sector "rises with the wind"

On 18th, the the State Council executive meeting proposed to promote the consumption of home appliances and furniture, and on 19th, the home appliance sector strengthened obviously. Straight flush data shows that as of the close of the day, the household appliance industry index rose by 3.33%, ranking second in the increase of Shenwan first-class industry index. 70% of the stocks in the sector rose, among which Julong Technology and Whirlpool had daily limit, Wanhe Electric, Changhong Huayi, Hisense Home Appliances and other stocks rose by more than 5%, and Midea Group, the industry leader, rose by 5.27%.

Bank of China Securities believes that in the short term, the prosperity of mandatory home appliances will continue to rise, and the demand side will be good next year, and the valuation is relatively reasonable. In the long run, the completion logic is expected to return again, driving the demand of the home appliance industry to make up; At the same time, the advantages of low cardinal utility in the white electricity and kitchen appliances sectors are obvious, and the trend of industry prosperity recovery is relatively established; After the economy gradually recovered from the impact of the epidemic, the recovery of consumption power was mainly reflected in the increase in the demand for diversified household appliances in a long period after the completion of the consumption of compulsory household appliances.

At the same time, the Standing Committee of the State Council made clear a number of measures to support the development of "internet plus Tourism" and pushed the leisure service sector higher. On the same day, the leisure service industry index rose by 2.78%, and 27 of the 37 stocks in the sector rose.

The auto sector, which had been rising for two consecutive days, opened higher and went lower on the 19th, and its performance was relatively weak. The automobile industry index fell by 0.62% that day. Among them, Changan Automobile led the decline by 9.31%, while Luchang Technology, InBeor and BYD fell more than 3%.

Despite the poor performance of the market that day, institutions are still optimistic about the continuous pulling effect of increasing the number of policies on automobile consumption. Essence Securities pointed out that the regular meeting of the National People’s Congress held on the 18th highlighted three major measures to expand automobile consumption, namely, increasing the number plate index, going to the countryside for automobiles and exchanging old ones for new ones. Among them, all localities are encouraged to increase the number plate index, and the purchase restriction may be further loosened; The resurgence of cars in the countryside will benefit independent brands; The trade-in policy will come out again, and the renewal of old cars is expected to accelerate. Since February, the central government and local governments have successively issued a number of automobile consumption policies. This regular meeting of the State Council once again emphasized the expansion of automobile consumption, which is expected to lead to the introduction of more automobile stimulus policies.

In recent months, thanks to the strategy of expanding domestic demand and the continuous efforts of various policies to promote consumption, the automobile market demand has continued to recover and corporate profits have steadily rebounded. According to the latest data of China Automobile Association, in October, the production and sales of automobiles in China reached 2.552 million and 2.573 million respectively, up 0.9% and 0.1% from the previous month and 11% and 12.5% from the same period last year.

Optional consumer materials keep the economy up.

At present, the recovery rhythm of China’s consumer market has attracted much attention from the market. Some brokers said that the pace of consumption recovery is expected to accelerate due to the continuous strengthening of policies and the continuous repair of the market.

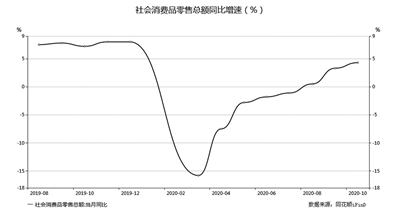

According to data released by the National Bureau of Statistics on the 16th, in October, the total retail sales of social consumer goods increased by 4.3% year-on-year, and the growth rate was 1 percentage point faster than that of the previous month. Of the 18 categories of retail sales of goods above designated size, 17 have achieved growth, of which 9 categories have maintained double-digit growth. The head of the Consumption Promotion Department of the Ministry of Commerce said on the 17th that in October, driven by the National Day Golden Week and various consumption promotion activities, the consumer demand of residents was fully released, and the total social output accelerated, showing the great potential, strong tenacity and exuberance of China’s consumer market after the test of the epidemic.

However, many institutions have pointed out that the social zero data in October did not exceed expectations. Guotai Junan International said that although the growth rate of China’s total social income in October was lower than expected, it still reflected the sustained recovery of domestic consumption, and the domestic retail industry had stepped out of the haze of the epidemic and continued to improve. According to the analysis of Northeast Securities, although the zero growth rate in October was not as good as the market expectation, it was not bad structurally. There are two main factors that drag down consumption: first, the catering industry is still recovering slowly, which is because residents’ willingness to go out for catering consumption in the post-epidemic era is still relatively low; Second, the consumption of oil and products has dropped a lot, which is caused by the weak international oil price. It can be seen that the impact of consumption is mainly exogenous factors, and from the perspective of economic endogenous demand, consumption in most industries has increased well.

"Considering that residents’ income level and residents’ willingness to consume have certain room for improvement, the follow-up residents’ consumption is expected to continue the repair process." The research team of Mingming Bond of CITIC Securities believes that the current growth rate of household consumption is still far lower than the growth rate of disposable income, while household deposits are still at a historical high level, which shows that there is still much room for household consumption to rebound. Considering that with the continuous restoration of the tertiary industry and the continuous effectiveness of the policy of stabilizing employment, there is room for improvement in the income level of subsequent residents and their willingness to consume (corresponding to marginal propensity to consume), and the growth center of consumption during the year is expected to continue to rise.

Founder Securities said that from the overall characteristics of the optional consumer sector, the sector valuation system is relatively stable, and the performance fluctuates obviously with the economic cycle. The probability of systematic revaluation of the current sector as a whole is small. On the performance level, with the continuous recovery of China’s economy, the optional consumption sector maintained a good trend of prosperity in the fourth quarter with a high probability, and the annual performance was highly certain. On the whole, the overall performance boom of the optional consumer sector can be maintained at least until the first quarter of next year. It is the main direction in the future to select sub-sectors and individual stocks with sustained and certain performance.