Whether it is the hot one or the upcoming one, without exception, it is divided into the subordinates, and many people regret that there is no model. Maybe these people have ignored their brands. After the introduction of this luxury medium-sized one, the market share occupied by this luxury medium-sized one is still unmatched by competitors. In fact, it seems that it has only been 10 years since its debut, but why did the first generation model sell for so long?

The first generation was launched in April 2008

The first generation made its debut in Los Angeles in November 2007, and then made its world debut in 2008. At that time, it was already full of confidence in the prospects of the Chinese market, and it was a representative of "official cars". It was on the A4 platform that a medium-sized one was developed. The appearance continued the design style of the third-generation Q7, and the exaggerated air intake grille showed the fashion and dynamic.

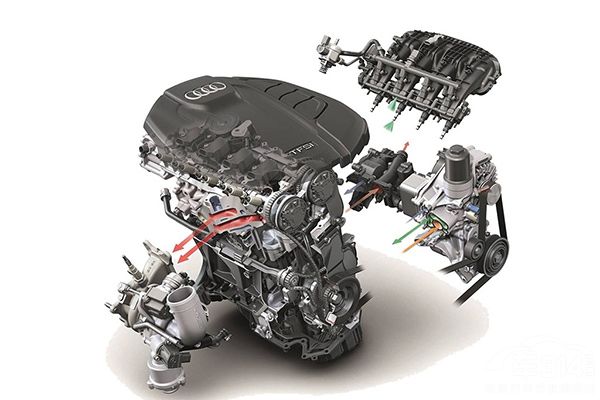

There are no bright spots in the interior design, but the configuration is equipped with high-end equipment such as adaptive cruise, three-zone automatic air conditioning, rear sunshade, MMI operating system, and/or ventilation. In terms of power, it is equipped with a 2.0T and 2.0T, two diesel, matching 6-speed manual and 7-speed. Among them, the 2.0T is the second-generation EA888, 211, and the peak torque is 350 Nm.

Although the first generation was claimed to be dynamic and all-round at the beginning of its launch, it was equipped with a quattro system and a sensitive driving mechanism. However, considering the affordability, the electronic equipment was quite helpless when it intervened, and it was not equipped with a wheel-to-wheel slip limit device, which greatly reduced the off-road performance.

In October 2009, the domestic price was introduced by import 577,000

On October 29, 2009, the Q5 was officially listed in the Chinese market, with a price range of 57.7-67 8,000, which disappointed some domestic consumers. The model only provides 2.0T and 3.2L two kinds of power, both matching 7-speed, and standard quattro system. At the press conference, the domestic pre-sale price range was also announced: 37-530,000 yuan, and the domestic Q5 became the only expectation.

In March 2010, the whole system of 2.0T + 7-speed dual-clutch combination was launched in China

After the first domestic launch in 2009, it was finally officially launched in March 2010. The price range is 37.98-53 9,800, which is slightly higher than the previous pre-sale price. As the first domestic medium-sized luxury, the shape and configuration are basically the same as the imported version. The power system only retains a 2.0T, which also matches the 7-speed. Because of the outstanding advantages in cost performance, it is logical to increase the price to lift the car.

November 2010 New Q5 Replacement 8AT

Less than a year after the new car was on the market, it couldn’t wait to launch a new model, replacing the original 7-speed with 8AT. Not only is the gear shift smoother, but without the concerns of dual clutch, the intervention of the electronic assistance system has become unscrupulous, and the off-road performance has been greatly improved. In other aspects, it is basically the same as the previous model, still equipped with the second-generation 2.0T EA888.

In April 2013, a mid-term facelift was carried out, and a new manual model was pushed down.

In 2013, the mid-term model was launched, which was mainly adjusted for details, and the shape of the front face, headlights and rear exhaust were changed. In addition to the new steering wheel, the configuration has also been improved, using the latest generation of MMI multimedia information interaction system. In terms of power, the domestic model launched a 2.0T low model, matching 6 speeds; the model was replaced with mechanical supercharging, and there was a 2.0T plug-in system model.

In December 2014, the whole series replaced the third-generation EA888

In 2014, the Q5 model was replaced with the third-generation EA888, which mainly added hybrid injection technology. The maximum output was increased from 211 to 224, and the peak torque remained unchanged. The new model still retains the low-end model, which is also matched with 6 speeds. In addition to the update of the power system, the high-end model can also be equipped with a "driving mode selection" system to achieve different driving feelings.

In September 2016, the second generation of the world premiered and returned

The new generation of the new model officially debuted in 2016. The front face is shaped like a scaled-down version of the Q7, with sharp and tough lines. The side and tail retain the general outline of the current Q5, and it still looks classic, which is a tribute to the previous generation. The new car is also built on the same MLB Evo platform as the previous model, which is expected to be greatly reduced.

The biggest change that the new can see is the interior design, which is enough to throw off the current model for several streets. At the same time, 12.3-inch full LCD instrument, electronic shift lever, wireless mobile phone charging, these high-end configurations are readily available. In terms of power, the new 2.0TFSI, 2.0TDI diesel and DI diesel are equipped with three models, matching 6-speed manual, 7-speed dual-clutch and 8-speed manual (DI diesel models only). In addition, in addition to the DI diesel model, which continues to match the quattro four-wheel drive system, the rest of the new models are a set of so-called quattro Ultra, which is actually the system.

2018 Quarter 1 Domestic listing lengthened

In order to meet the needs of domestic consumers, the new or the same as the A4 will be extended on the basis of the overseas version of the domestic model, and the new car will be launched to the domestic market in Quarter 1 in 2018. The domestic model will be the same as the current model, only a 2.0TFSI code-named third-generation EA888 will be retained, matching 7-speed. As for the four-wheel drive system, it will also be replaced by the latest quattro ultra system.

Editor’s summary: The current model is a car that is relatively balanced in all aspects, with rich configuration, abundant power, good handling performance, and most importantly, this car has no obvious shortcomings. This new generation of models uses a more advanced platform, and some high-tech configurations have also been devolved to Q5. For ordinary consumers, it has a greater temptation. But the absence of the quattro four-wheel drive system will somewhat affect consumers’ determination to buy it.